Everyone says that the economy is terrible, but if that’s the case, why do the economic indicators say otherwise?

I wrote last time about my current take on the sentiment of the majority of the country.

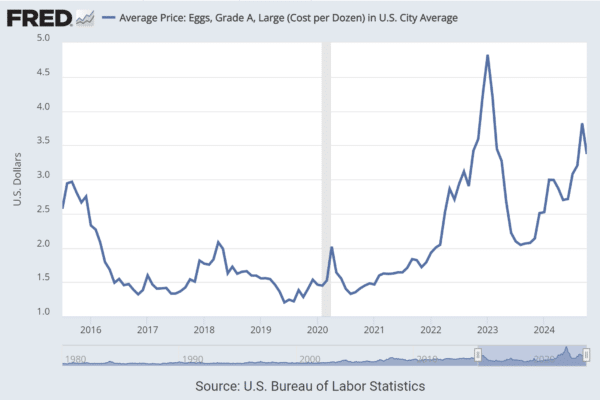

“Forget about women’s reproductive rights or the rule of law…have you seen the price of eggs!?”

If you must know, the price of eggs, though certainly higher than they were in the beginning of the pandemic (not exactly what you would call a normal situation) is roughly 10% higher than they were in 2015.

There seems to me to be a serious divergence between how the economy says people are doing, and how people feel about how they are doing.

I mean, is the economy really bad as people think? The data says otherwise.

Though as for whether we should trust the data, that’s a different story.

Table of Contents

The numbers don’t lie

Let’s take a look at some statistics.

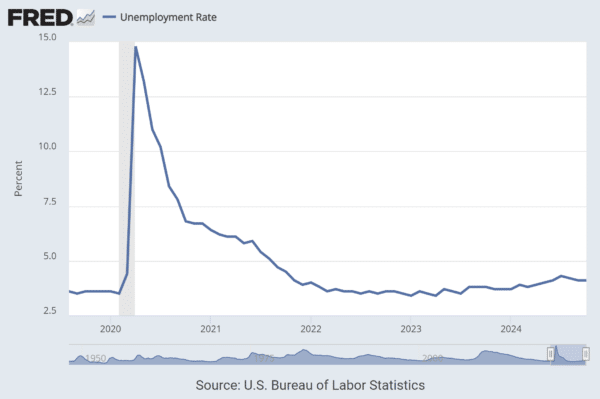

First, the unemployment rate. As of October 2024 it was 4.1%. While not as low as 2022, this is almost the lowest the rate has ever been in recent history.

That’s pretty good, as it means that people who want a job are finding one.

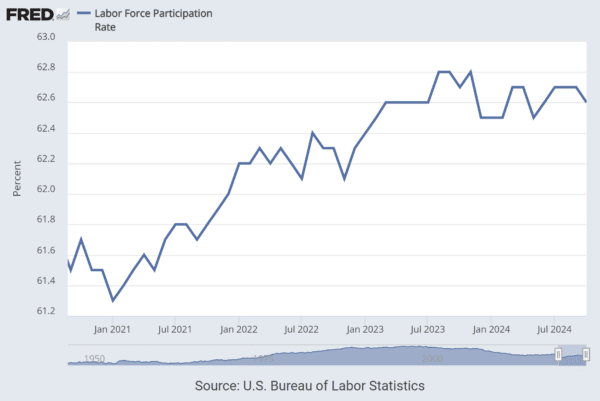

The Labor Force Participation Rate is up too. In fact, it has risen every year over the last few years.

Now let’s move onto Gross Domestic Product, or GDP. According to the U.S. Commerce Department’s Bureau of Economic Analysis (BEA), GDP is up 12.6% under the Biden Administration, growing 2.8% in the third quarter of this year alone.

Let’s keep going. Household income in the U.S. has shot up in recent years too, after some stagnation after the financial crisis of 2008. From 2020, income has gone from $68,000 to over $80,000 in 2023.

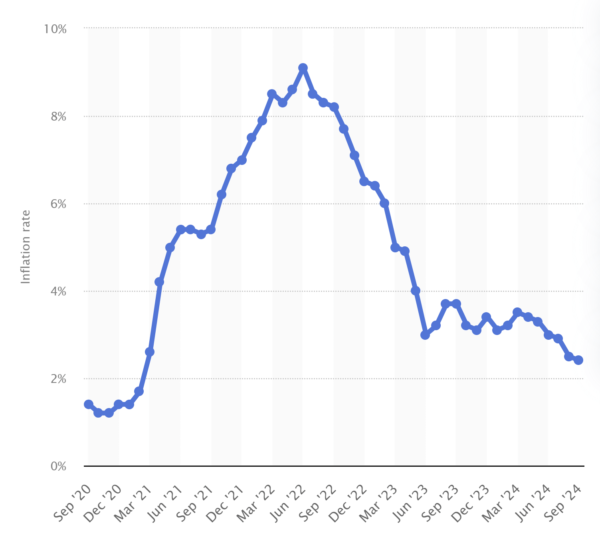

We of course have to look at inflation too. Now we all know that inflation was very high for a while there in 2022; there’s no other way to look at it. But it’s also true that inflation has basically come back down to normal again.

And this is without a recession, something that, as far as I can tell, has never happened before in modern U.S. history. Every time the Fed has raised rates to counter inflation, it has led to a recession. But not here.

This should be a good thing, right?

The numbers do lie

So why are some people so pessimistic about their financial situations?

Well, first of all, some people’s situations are dire. We can’t discount that, of course.

Plus, when you have a large segment of the media (social and otherwise) telling you that everything is terrible all of the time, that hardly helps.

Plus, there are some fundamentals that are still not great. I wrote about this in the post “Why everything today is more unaffordable“, only two years ago. Here’s what I wrote:

In 1970, a household would have to work for 21 months (1.75 years) to buy a house, and 4 months to buy a new car. Today, a household would have to work for 52 months (4.3 years) to buy a house, and 6 months to buy a new car, which is 250% and 150% longer, respectively, than in 1970.

Similar statistics can be shown for education too. And of course, people in the 1970’s weren’t buying smartphones or Amazon Prime.

So this certainly offsets some of the wage gains, though I’m not sure by how much.

It’s a wash

Economic sentiment is low these days. According to Pew Research, as of the beginning of this year, About 28% of Americans rated economic conditions as “excellent” or “good”, while 31% said they were “poor” and about 41% said “fair”.

Those who rate the economy as good, say so due to low unemployment, inflation being down, wage growth. Those who don’t rate the economy as good point to high inflation, high cost of living, and wages being low.

Look at that again. Two out of those three points are in direct contradiction. Are wages good or not? Is inflation down or not? We all clearly don’t agree.

Could it be that our economic sentiments are due to things outside of economics? And if so, what does that portend for any future shared reality?

You have more control than you think

Ultimately, I believe that you have more control over your financial situation than you think.

On the income side, I believe that it is possible to advocate for high income. It’s not easy, but it’s possible.

And on the spending side, here is where I think you have the most control. And I don’t mean that your goal is to spend less, but instead, to spend intentionally, in line with your values.

You probably spend money on things that you either don’t notice or don’t enjoy. Have you looked at your subscriptions recently? Do you know how much you’re spending, and on what? I bet you that you don’t. But I also bet that when you start paying more attention to where your money is going, you’ll feel like you’re in a better place than you do now.

Taking control of your finances will help you feel better, more empowered, with better ability to plan for the future as well as live for today.

And when you have eliminated spending that you don’t even care about, then, frankly, you’re not going to care about the price of eggs.

I’m not saying that if more people followed my program that the election would have turned out a different way. I’m just saying that while there are certainly negative economic challenges out there, there’s a lot about the economy that’s doing great right now, and sentiment doesn’t match that.

And I just wonder if by taking control of your own financial situation, that you might feel a little better about things too.

Many of the sources here were compiled by Patrick Boyle in his excellent recent video about the state of the U.S. economy. Thanks.