It’s not important to earn interest on your emergency fund, but if there is no downside, then why not do so, now that rates are so high?

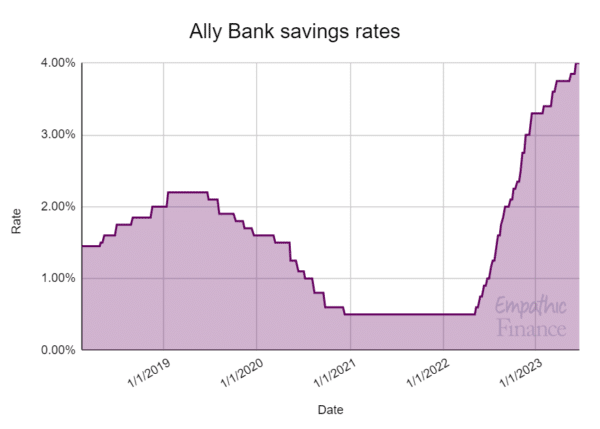

Interest rates have been rising for over a year now. This is bad news if you have credit card debt, a variable-rate loan, or are trying to get a mortgage.

But if you’re trying to earn interest, specifically in a savings account, you’re in luck.

Most savings accounts in major banks don’t offer any interest. For example, I just checked, and Bank of America appears to be offering between 0.01-0.04%. That means that if you put $10,000 in an account, after a year you will have earned between $1-4 dollars. You could probably earn more by picking up pennies on the street.

Meanwhile, a different class of banks have been around for quite a while now, usually called “online savings banks”, who differentiate themselves by not having retail branches and other standard conveniences of a bank.

But they do earn interest. And at the time of writing, you can earn between 4-5% with these savings accounts. That means that that same $10,000 will net you $400-$500 a year.

Money in online savings banks can’t be accessed instantly. You usually have to wait a few days for processing. That means that’s it’s best for money that you don’t access very much.

And you know what kind of money is perfect for an account that you don’t access very often?

Your emergency fund.

It won’t be life-changing, but it is free money. And I’m a big fan of free money. Aren’t you?

Table of Contents

Insurance not investment

Your emergency fund is a savings account that is to be used only in the event of an emergency. (What’s an emergency? Glad you asked.)

This is money that just sits around and does nothing, which can make some people uncomfortable. After all, shouldn’t money be doing something?

But that misunderstands the point of an emergency fund. While it looks like savings, and therefore some think it should be an investment, it’s actually insurance. That’s right, just like car insurance or health insurance.

What you’re doing with an emergency fund is “self-insuring”, such that when an emergency happens, you can “pay out” to yourself. (Plus, the paperwork is much easier.)

You wouldn’t look back at a year’s worth of car insurance payments and say that the money was wasted if you didn’t get in an accident, would you? I hope not, because that was the role of insurance.

Easy money

The most important part of an emergency fund is that it needs to remain liquid. You shouldn’t have to pay a penalty to get at your money, which is why you don’t want to invest your emergency fund money.

So a savings account is a good place to put it.

Generally speaking, when people have emergency funds, they tend to keep them in the same bank with their checking account. And that makes sense, is fine, and is certainly simpler.

But it’s also not necessary. There’s basically no typical situation where you should ever need your emergency fund money immediately. Emergencies don’t typically happen at gunpoint.

So a savings account that lives online is also perfectly fine, even if it’s not the same as your normal bank.

And if this account is earning 4% or more, then that’s just a bonus.

Lots of easy money

I recommend that your emergency fund be equal to at least six months of your spending. This isn’t the same as six months of income, as presumably you’ll cut down on some expenses (and bills!) when you’re in an emergency.

But either way, we’re looking at a typical emergency fund need of anywhere from $15,000 for a person just starting out to $50,000 for a family of means.

And for reference, $50,000 sitting in an account earning 4% interest will net you $2,000 per year. Doing nothing.

That to me is a lot of easy money.

Switching is easy

If you’ve never used an online savings bank, here’s a list of them. I don’t have any recommendations, but am fine saying that I’ve used Ally Bank for many years now, and am perfectly happy with them.

As a rule, I wouldn’t bother switching if the interest rate difference is 1% or less. Meaning, if you’re already earning 3% in your current savings account, that’s a lot of hassle for not a lot of extra money.

But if you’re earning 0.01% right now, I think it’s a no-brainer to start earning some easy, liquid money with the money you already have sitting around.

And if you don’t have an emergency fund yet, now is probably a good time to start building one. If you need help figuring out how, you can schedule a free call with me and we can explore options. It’s never too soon, and it’s never too late.

2 Comments

Anne

Clear and helpful as always, Mike! What do you think about putting emergency funds in a conservative money market? For example: https://investor.vanguard.com/investment-products/money-markets#:~:text=Can%20I%20lose%20money%20when,capital%20preservation%20is%20not%20guaranteed. While the lawyers of course need to tell Vanguard that there is always a risk of losing money, does that actually happen such that it is better to put emergency funds in an online high yield savings account? I looked through my very helpful notes from your M-Path class but I did not see this question addressed, and I did not see it in your post either so I just thought I would ask!

Mike Pumphrey

Hi Anne. Great question. There are really two issues at play here. The first is whether you’re comfortable with the risk you’re taking on. A money market, or really any investment that’s not insured against loss is inherently more risky than one that is protected. It’s really up to you to weigh the risk of potential loss against the potential increased returns.

The other issue is one of liquidity. If you do use a brokerage firm like Vanguard for your emergency fund, you want to make sure that you’re not using a tax-advantaged account (like an IRA) for your emergency fund, otherwise withdrawal will lead to penalties that will dwarf your earnings.

The fund you linked to is returning less than a percentage point higher than a typical online savings account, so to me, that’s not really worth it. Also, it’s long term average is more like 1.5% which is really not worth it. But if it fits with your goals, and you feel comfortable with it, that’s what’s most important.