There are two types of IRAs (Individual Retirement Arrangements): Traditional and Roth. Which one is right for you?

Your retirement isn’t going to fund itself. Long gone are the days of a jobs that would provide pensions if you worked there long enough. If you want to have a comfortable life in the last decades of your time here, it’s up to you to make it so.

Some people think that real estate is their ticket to riches, or maybe building a company and selling it. Some people want a get rich quick scheme.

I don’t think those things are possible for most people, but one thing most people can do is put money into investments and wait around for them to appreciate in value. Uncomplicated, right?

Now there are three ways to put money into investments:

- Through work (in a 401(k) or similar)

- Through an IRA

- Through a brokerage account

Most people are going to opt for the first (if you can), but everyone should be able to do the second. That’s because an IRA is available to everyone, regardless of type of employment, as long as you have some kind of taxable income.

But there’s a question here: Should you contribute to a Traditional IRA or a Roth IRA?

That’s what we’re going to talk about today.

Table of Contents

IRA details

An IRA is an Individual Retirement Arrangement. It’s an account that is tax-advantaged in certain ways around the subject of retirement (meaning around age 60 and above).

There are two types of IRAs, a Traditional IRA and a Roth IRA. They are more similar than they are different, but they are different in important ways.

Both the Traditional IRA and Roth IRA allow you to invest money in securities (mutual funds, stocks, bonds, etc.) and not have to pay taxes on earnings while the money is in the account. So if you’ve heard about “capital gains taxes”, that is a thing that you won’t pay with money in one of these accounts.

This means that putting money into an IRA will not only earn you money (if invested correctly), but also save you money, because you’ll pay less taxes.

As of the time of writing, you can contribute a maximum of $7,000 a year to an IRA, and if you’re over 50, you can contribute a maximum of $8,000 (check this page for updates). And you’ll get charged penalties if you withdraw money before you turn 59 1/2.

Traditional IRA details

It used to be that there was one kind of IRA. This was it. (Thus the “traditional” part.)

The way it works is that you can contribute money to an IRA account, and when you go to withdraw the money later, you’ll pay taxes on it. To make sure that you aren’t paying taxes twice, you’d get a tax deduction when you contributed.

Now, there are some caveats and complications around this, mainly if you make a lot of money, but just know that you’ll never be paying taxes twice.

And more importantly, you can contribute to a Traditional IRA no matter how much money you earn. Keep that in mind.

Roth IRA details

Meanwhile, there’s the Roth IRA option. This inverts the tax situation from above. When contributing to a Roth IRA, you don’t get any tax deduction at all, but when you go to withdraw money later in life, you don’t pay taxes on it at all. What you have in the account is what you get.

But it gets better. Because this money has already been taxed, it’s more flexible that other types of arrangements. For example, you can always withdraw your contributions tax-free. Moreover, you can withdraw money if it’s used for a first-time home purchase, and you won’t pay a penalty for that.

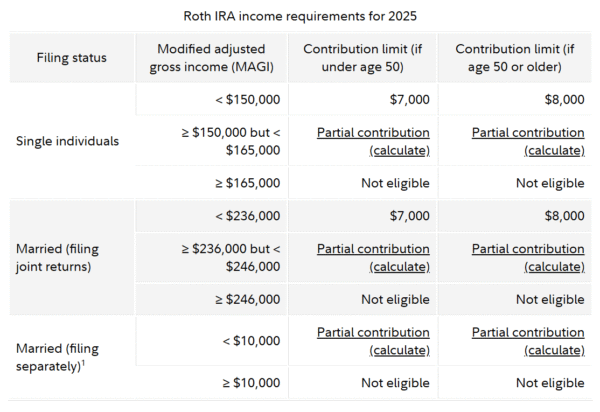

Now, there are caveats to this as well. The biggest caveat is that if you (or your household, if you’re married) make too much money, you won’t be eligible to contribute to a Roth IRA. A Traditional IRA is all you have.

This happened to me a few years ago. I actually contributed to a Roth IRA and then found out that I earned too much money to be eligible. I had to withdraw my excess contributions, and while it was doable, it was a little annoying.

So if you think you’re on the fence (here are the income limits, which depend on your tax filing status), I would hold off until you know what you’re actually making for the year. You can contribute after the year ends for the previous year, as long as you do it by tax filing time.

Fidelity has a great reference table, which I’m reproducing here:

The surprising answer

So, with all that in mind, should you contribute to a traditional IRA or a Roth IRA?

The answer, most simply, is: Yes.

An IRA is a retirement account that you own, that you control, and it doesn’t have anything to do with your job. You decide what company will hold your account, and you decide which investments to choose from, not limited by what your work account provides for you.

Maximum control and maximum flexibility. It’s kind of perfect.

Yes, but which one?

Okay, okay, I’m sure you thought this would be a cage match between the two different types of IRAs.

Well, obviously this isn’t financial advice, but here are some considerations.

I’ve talked about the Roth here for years, and I love it. Yes, you don’t get a tax break now, but you get certainty. The amount you have in you Roth is the actual amount you have. That isn’t true with a Traditional IRA.

Here’s what I mean. If I have $500,000 in a Roth IRA, I could withdraw all $500,000 of it at once, and just have $500,000. However, if I had $500,000 in a Traditional IRA and withdrew all of it, I would need to pay taxes on that $500,000, netting me considerably less than $500,000 when all was done.

And you can also withdraw your contributions at any time, withdraw money to buy your first home, and your money isn’t subject to Required Minimum Distributions (RMD), so you can withdraw only what you want (or leave it to someone else).

So I’m on Team Roth, but I also have a Traditional IRA too. I’ve contributed to this in the past when I haven’t been eligible to contribute to a Roth. It’s quite nice to get the tax deductions now, which could save you thousands of dollars up front.

So there are benefits to both. And you can contribute to both, so you don’t have to choose! The only thing to note is that the contribution limit is for both types of IRAs combined. So you could contribute $3,500 to a Traditional IRA and $3,500 to a Roth IRA in one year, but not $7,000 to each.

And then, of course, you actually have to decide what investments to put your money into. But that’s a subject for another time.

Start an IRA today

If you haven’t started an IRA, start one today. I have a post on how to open a Roth IRA with Vanguard, so you can start there. But no matter what brokerage you use (Fidelity, Schwab, etc.) the process is almost certainly straightforward.

And even if you don’t have much money to contribute to an IRA, open one anyway, so that you are ready to start contributing as soon as you can. That compound interest, money-making-money thing takes time, so the sooner you get started, the better.