You may wish to invest your money in line with your values, but what are the costs to socially responsible investing?

The more you dig into the nuts and bolts of investing, the more questions you might have.

I’m not just talking about “what is a Roth 401(k)?” or how to allocate your investment money. I’m talking here about where your money goes when it’s invested.

And when you start to think about where your money is going, you may start to ask yourself whether your investments are in line with your values. You don’t donate to causes you don’t support, so why would you invest your money in companies you dislike?

That’s a good question, and there are good reasons on both side.

So let’s dig into socially responsible investing, as well as the pros and cons.

Table of Contents

What is Socially Responsible Investing?

Socially Responsible Investing (SRI) is the process of investing in line with an investor’s values. As Investopedia puts it:

Socially responsible investing (SRI), also known as social investment, is an investment that is considered socially responsible due to the nature of the business the company conducts. A common theme for socially responsible investments is socially conscious investing.

You might also hear the phrase “Environmental, Social, and Governance (ESG) investing”. You might also hear the phrase “impact investing”. These are all sort of different, sort of the same, and all not differentiated well, but the details don’t really matter for us here.

What does it mean to be socially conscious? Generally, socially conscious investing means avoiding investment in certain companies that perform in sectors or in ways that the investor disagrees with.

From S&P itself:

Socially responsible investors actively avoid investing in companies or organizations whose businesses run counter to their nonfinancial values and ethical principles or those they perceive to have negative effects on society; including businesses across the alcohol, tobacco, fast food, gambling, weapons, fossil fuel, or defense industries.

Investing in companies you hate

Let’s be honest. If there’s a large company you disapprove of, unless you go out of your way to avoid it, chances are you are investing in it.

Here’s a short list of companies with high returns that many dislike. They include, McDonald’s, Coca-Cola, and Exxon Mobil, among many others. All of those are part of the S&P 500 index, so chances are, they are in your portfolio.

This is because most of the time, we aren’t investing in individual companies (see my hot stock tip), but mutual funds that track a particular market index, which is like buying a piece of hundreds or thousands of companies.

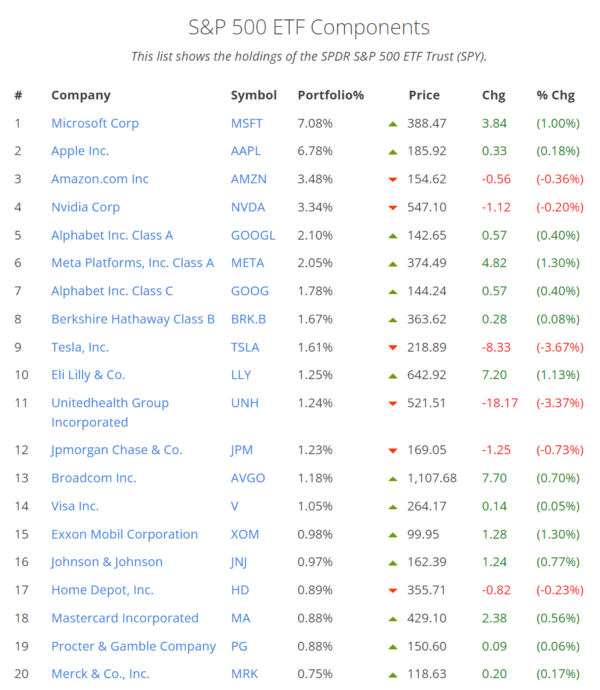

Here is a list of all the companies in the S&P 500. See if you can spot one you dislike:

What are the alternatives?

In the past, there used be a single alternative: if you wanted to exclude certain companies, you had to buy individual stocks and, in effect, make your own personal index fund.

You can still do this, but this has a lot of disadvantages.

First, by reducing the number of stocks you invest in, you increasing your risk of one company doing poorly and tanking down your portfolio. And you’re certainly not going to buy 400 stocks, eliminating the 100 you dislike.

And also, it’s just a lot more work for you.

Luckily, in recent years, socially responsible indexes have cropped up. The FTSE4Good US Select index excludes certain sectors:

The FTSE4Good US Select Index measures the performance of US stocks after excluding companies involved in Vice Products (Adult Entertainment, Alcohol, Gambling, Tobacco), NonRenewable Energy (Nuclear Power, Fossil Fuels), and Weapons (Civilian Firearms, Controversial Military Weapons, Conventional Military Weapons). Companies are also excluded based on Controversial Conduct and Diversity practices.

And Vanguard’s FTSE Social Index Fund (VFTAX) tracks this fund. I’m not promoting this particular fund, just showing you that options are available.

What are the risks?

There are two risks as I see it.

The biggest risk is that your returns will be lower than if you invested more blindly to a company’s actions.

Now, the question of how much socially investing can hurt your returns is difficult, and you can easily find arguments on both sides:

It might be worth it to earn a lower return though, depending on your needs.

The other risk is that you invest in a socially responsible fund, and then find that it actually doesn’t totally align with your values. For example, some funds might eschew tobacco and fossil fuels, but might invest in private equity firms, which I’d argue are responsible for most of the recent massive bankruptcies in the country. Is it worth it when not all of your values are reflected?

What is the opportunity cost?

The other point to consider, one that most arguments on this topic seem to miss, is the opportunity cost of making less returns due to investing based on your values.

We don’t want to donate to causes we don’t support, but if we were able to generate outsized returns from those causes, we could then have more money to invest in companies that we do support.

If your returns offered you, say, $100,000 more over the long run by “investing with the devil”, to coin a phrase, then you could have $100,000 more over your life to give as you choose. Like, for example, to these companies (just a suggestion).

Personal choice

As you can see, this is not a simple choice, and really comes down to matters of taste and preference and need.

Personally, I haven’t yet found a socially responsible fund that I am totally confident in for the long term, and have no interest in picking individual stocks. So at the moment, I’m going for as high returns as possible, and then using this extra money toward causes I support when I am able. And in the meantime, I can spend my non-investment money based on my values.

But I would totally understand and support if you decided otherwise, and went full in on values-based investing. At the end of the day, we need to do our part to support the causes we believe in, however we decide to do it.