Whether through fear of economic collapse or just in protest, you may be wondering if you should sell your investments in U.S-based funds.

Nothing here should be considered financial advice. Please see my Disclosure Policy.

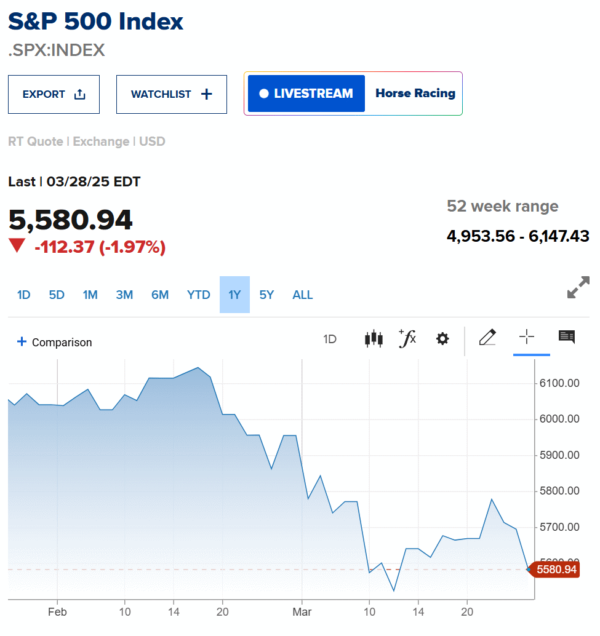

As of the end of March 2025, the stock market looks wobbly.

Here’s the S&P 500 index since February.

Not great.

Auto tariffs are going to make the cost of cars more expensive. Actually, “everything tariffs” are going to make everything more expensive.

This shouldn’t be a matter of debate. After all, even if you want to on-shore business, it’s not like companies can snap their fingers and build a factory in the U.S. instantly. That takes years. And in the meantime, every one of us will pay the price for importing things.

Add in the toddler-like flexes toward other countries, plus the rampant destruction of jobs and eliminating guardrails that keep Americans safe and healthy.

Oh, and while I don’t actually think it really matters, but the price of eggs isn’t going down either.

It’s hard not to come to the conclusion that this is the beginning of something bad.

So what now?

If you’re worried about the stock market crashing due to all of these factors, you’re not alone. You might also not want to support certain businesses that have bowed their head to a would-be autocrat. So if you have investments, be it your 401(k) or IRA or the like, you may be asking yourself if it’s time to sell some of them.

Let’s talk about it.

Table of Contents

What’s a U.S. equity?

U.S.-based equities are what most of us have. If you have an index fund that tracks the S&P 500 or Russell 3000 or something like that, those are U.S.-based companies you’re invested in.

A lot of your non-index mutual funds are U.S.-based as well.

How do you know whether a fund that you own is based in the U.S.? You can look it up with the Securities and Exchange Commission, at least until they all get fired too. But you can also look at the fund’s prospectus. Also, you can just Google it.

Option 1: Sell outright

If you believe that we’re in for a crash, you could sell some of your stocks and funds outright.

Keep in mind that there could be tax consequences for you, depending on the type of account you have. Tax-sheltered accounts like the 401(k) or IRA are usually okay, at least if you don’t withdraw the money but instead sell the investment within your account. (You definitely don’t want to withdraw the money, as you’ll likely face steep penalties.)

But if you just have a regular brokerage account, selling means you’ll likely have to pay capital gains taxes (assuming your value has gone up). That’s most likely a 15% tax on your earnings, a pretty hefty blow.

Option 2: Switch to international equities

You may instead wish to rebalance your portfolio.

While most (if not all) of your investments may be in U.S.-based funds, you may have some international funds in there as well.

And if you don’t, perhaps it’s time to add those in.

Funds that track international indexes are generally employed to introduce extra diversification into your holdings. While the U.S. may suffer a recession (as all economies will at some point), it’s much less likely that the entire world will suffer equally at the same time. So if you have any money in international funds, you could be saved from greater losses.

That said, the reverse also holds, in that your non-U.S. holdings may be in recession when the U.S. is not.

The extremely problematic personal finance guru Dave Ramsey states that your investments should be 25% international. The Lazy Portfolios on Bogleheads—and if you need any one single page on the internet about how to invest, it’s that one—have that percentage all the way up to 33% in places.

What’s your percentage? Maybe you want to raise it a bit. You could sell some of your U.S.-based funds and exchange them for international funds. For example, with Vanguard, you could look at the Vanguard Total International Stock Index Fund.

But the same tax implications apply as above.

Will I sell any investments?

The stock market isn’t the economy…The stock market isn’t the economy…The stock market isn’t the economy.

I know it’s a cliche to say it, but it’s important to keep in mind.

The stock market’s moves are in many ways a reflection of short term sentiment. This sentiment often plays out in ways that turn out to be wrong. Remember the first few weeks of the pandemic when the stock market tanked? That didn’t last long at all.

The problem with making abrupt changes based on short-term sentiment is that you never know what’s going to happen in the longer term. Is the current situation in the U.S. marking a long-term decline, or just a pandemic-style blip? No one truly knows.

As I never grow tried of saying, there’s no point in doing any financial planning for massive, societal collapse, because at that point, none of your money is going to be worth anything anyway. So the only thing we can plan for is less dramatic situations.

I don’t know if the U.S. is about to crater, financially. I do know that I’ve thought that before, and every time we’ve said “this time is different”, it hasn’t been.

So I’m not selling any investments. Not now.

Will I move money towards international funds?

As for the international investment question, that is something I may look into. I do have some international mutual funds in my portfolio, and they are much less than 25%. I think it may be time to move some more money into funds less-dependent on the U.S.

But I won’t be doing anything right away. After all, what large economy is truly insulated from the U.S.? If the toddler-in-charge decides he wants to put tariffs on Pakistan or annex Gambia (unlikely), then that’s going to upend the financial situation there. International diversification may not be truly possible anymore.

So if you’re concerned about your nest egg, I would take a deep breath, do nothing, and just keep an eye on the evolving financial situation.

And then, perhaps contrarily, I would put more money into your investments, not less. This is a dark time in our nation, but we have to keep fighting to assure that we’ll come out on the other side. If we don’t see a bright future ahead, then we’ll need to work at it until we do.

And because of that, your portfolio will likely rise in value, eventually. Be ready for that, too.