I challenge the conventional wisdom that you should wait until age 70 to claim Social Security benefits in order to get the most out of it.

According to US News, the average monthly Social Security benefit as of 2022 is $1,657.

That’s not a lot of money.

How do you get that number to be higher? Well, you could earn more in income. Your benefit is calculated based on your 35 highest years of wages, so the more you earn in a year, the more you push out those lower- (or non-) earning years of your life.

But I’m sure “earning more income” is something no one ever thought of, right. So what else can you do?

Well, there is one surefire way to earn more from Social Security, and that’s to delay claiming until you’re older, specifically as old as 70.

But is that really a smart thing to do?

In this post, I’m going to talk about the conventional wisdom of claiming Social Security benefits, and get the real numbers to see whether it holds up.

Table of Contents

Claiming at age 62 versus 67

When you turn 62, you are eligible to apply for Social Security benefits. And you can apply at any point from there on.

But, assuming all else is equal (and yes, I know this isn’t a small assumption), the amount you’ll get is dependent on how old you are when you claim.

These days, most people’s “full retirement age” is 67 (throw out that 65 number in your brain; it’s old news). So if you start to claim benefits at 62, or at any time before 67, you’ll lock in a reduced amount, upwards of 30% reduced, with the reduction being eliminated the closer you get to 67.

So if your benefits were going to be $2,000 a month at 67, it’s likely to be around $1,400 at 62. That’s the difference between $24,000 a year and $16,800 a year!

Claiming at age 70 versus 67

The same thing works in your favor in the other direction though. If you wait beyond age 67, you’ll start to get delayed benefit credits which increase your monthly benefit amount, upwards of 24% if you wait until age 70.

So if your benefits were going to be $2,000 a month at 67, it’s likely to be around $2,480 if you wait to claim until 70. That’s the difference between $24,000 a year and $29,760 a year!

If you claim the moment you can (at age 62), you will earn about 56% less per month than if you waited until age 70. That’s a lot of money you’re not getting. This is why the conventional wisdom is that you want to wait to claim your Social Security benefits until you turn 70: you will make much more money when you start to claim.

Or is it?

The opportunity cost of waiting

“But wait!” I hear you say. “Even though I’d be making less per month, I’d have a head start of 8 years! Doesn’t that work out to be better over the long run?“

To be honest, I didn’t know the answer to that, at least not specifically. Perhaps you get more money in aggregate even though you make less per month overall? Does it ever make sense to claim early?

There’s only one way to figure this out: Math.

Don’t worry, I did all the math for you, and all you get is the pretty chart.

Calculating Social Security benefits

For this calculation, I went on to mySocialSecurity, the government website that has your current Social Security status, and I used the calculator to give me some potential benefit amounts depending on some varying circumstances I put in.

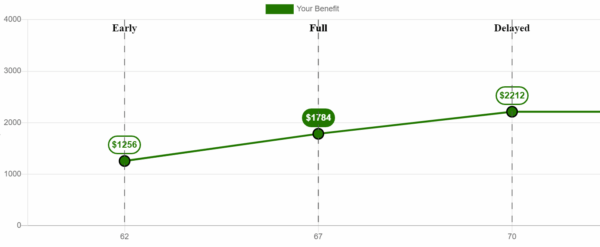

Here are the numbers it gave me for claiming:

- Claiming at 62: $1,256

- Claiming at 67: $1,784

- Claiming at 70: $2,212

So let’s see what happens when we compare these three scenarios.

Here’s the chart.

Let’s dig into what this tells us.

- From 62 to 67, obviously, you will make out with more money if you claim at 62 (red line). Even up until age 78, you will have put away more money if you claim at 62 versus claiming at 67 or 70.

- But after age 78, claiming at 67 starts to pull ahead (green line), and your total aggregate money outpaces claiming at 62.

- Claiming at age 67 holds as the champion until you reach around age 87, at which point, the scenario of claiming at 70 pulls ahead (blue line).

- From there on out, having claimed at age 70 is the clear winner.

Takeaways

This chart was pretty surprising to me.

One takeaway is that your decision to claim, and your attempts to maximize our total amount of money, is much more predicated on when you think you’re going to die than I had realized.

Assuming that you are spending this money and not looking to leave it to anyone else (and excluding the issue of spousal benefits), the answer of how long you live matters a lot.

If you think you’re only going to live to age 72, it makes sense to claim as soon as possible.

If you think you’re going to live to age 80, you might want to wait to claim until age 67.

And if you’re gunning to be a nonagenarian, then you want to wait to claim until age 70.

This is an uncomfortable line of thought to have, of course, and I don’t relish it. But the raw numbers don’t lie.

One other surprise for me is just how long you have to live before you see the perks of claiming later. Having to be 78 or older before you get to see what you gained by waiting to claim feels like a rather hard multivitamin to swallow.

Related, it surprised me just how little the benefits of waiting to claim are. Yes, you start to earn more money in total once you reach age 78 and then age 87, but it’s not a parabolic arc like with compound interest.

In fact, if you didn’t need this money and instead wanted to invest it when it came to you, I’m pretty sure that you’d come out ahead by claiming early, and getting the benefits of compound interest working for you. But that’s a chart for another day.

A consolation

I admit that this decision of when to claim reflects a certain amount of privilege.

Some people may not have the luxury to wait to claim benefits. Through inadequate retirement savings, enforced retirement, or disability, you may need that money quicker.

If this is your situation, the consolation for you is that it isn’t as terrible to claim early as you might have been led to believe.

Yes, you’re locking in a lower benefit for the rest of your life. But it’s still a guaranteed benefit. And that’s something you can’t say about waiting to claim until later in life.

What I’m doing

I’m years away from having to make this decision, thankfully, but at the moment, I’m tempted to still favor waiting until 70, as I’m personally planning on living a long time. If I need to stop working before I claim, I’ll be planning a bridge with my retirement funds to tide me over.

But I’ll certainly be watching this space. There are a lot of reasons why I could change my mind in the intervening years.

Eagle-eyed readers: Send me a note if you’d like a copy of the spreadsheet I used to calculate the chart. I’d love for you to check my work.