Many years ago, when I was first learning about investing, I decided to start my own IRA. At my coworker’s suggestion, I set up the account at Scottrade. Over the course of two years, I put a little bit of money in it, and then sort of left it alone.

In hindsight, I guess I thought that getting an early start on self-directed retirement was more important than paying off my debt. (I don’t believe this anymore.)

One thing I’ve always liked about this account is that it is a Roth IRA, so all my contributions will be non-taxable upon withdrawal. What I put in, I will get out.

Believe it or not, I’ve left this money in this account for over a decade. I’ve never exactly forgotten about it, but I haven’t done anything with it either. I guess I thought the process would be cumbersome and annoying. I pictured needing to fill out a bunch of forms, and maybe even having to stop by my local Scottrade office. I figured it would be as easy as signing up for CenturyLink internet service (which don’t get me started).

But, in the spirit of taking ownership of my retirement accounts, I recently initiated a transfer of this account to Vanguard.

Thankfully, the process was simple easy, and almost entirely automatic. Read on to see how I did it, and how you can too.

Table of Contents

Initiating the transfer

I sent an email to Vanguard customer service asking how to begin, and got a helpful response:

You can transfer assets held in an IRA at another financial institution to a Vanguard IRA(R) tax-free and without IRS penalties. Vanguard does not charge a fee to transfer assets.

If Scottrade allows electronic transfers, you can initiate your asset transfer online. […]

(They do.)

This is the link Vanguard gave me to initiate the asset transfer. At the moment it is the same as logging into your Vanguard account and selecting Investing → Account transfers → Start your transfer online.

This took me to a wizard. And this was the cool part: this entire process was initiated through a wizard. Once I completed the wizard, there was nothing else I needed to do!

So let’s move into how-to mode.

Navigating the wizard

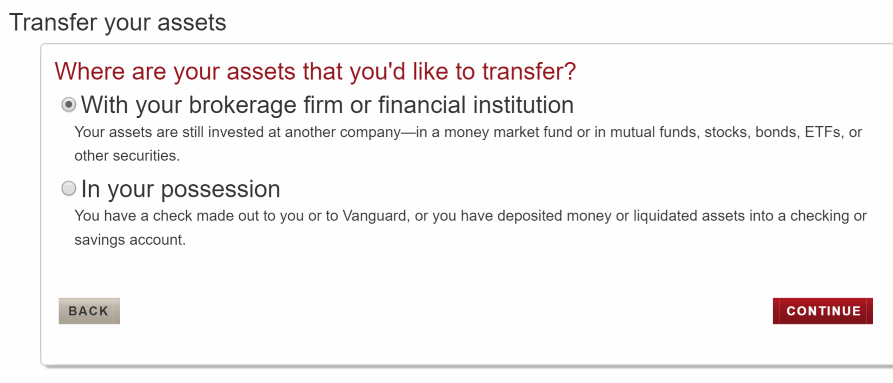

Select With your brokerage firm or financial institution, since this money transfer needs to be direct to avoid taxes and penalties.

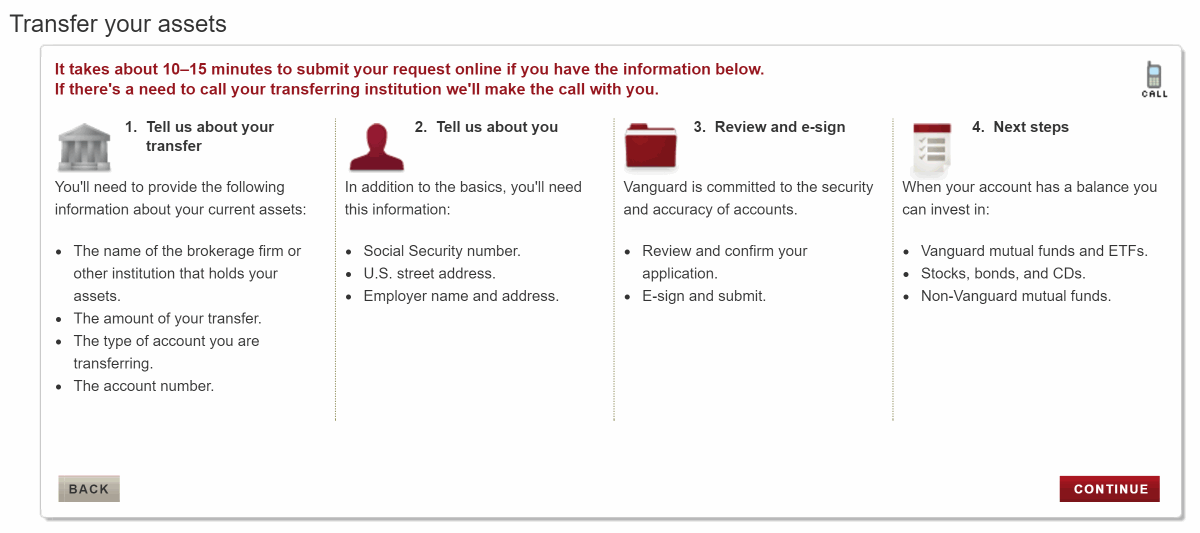

This page shows the process of the transfer. The tally of 10-15 minutes was approximately correct.

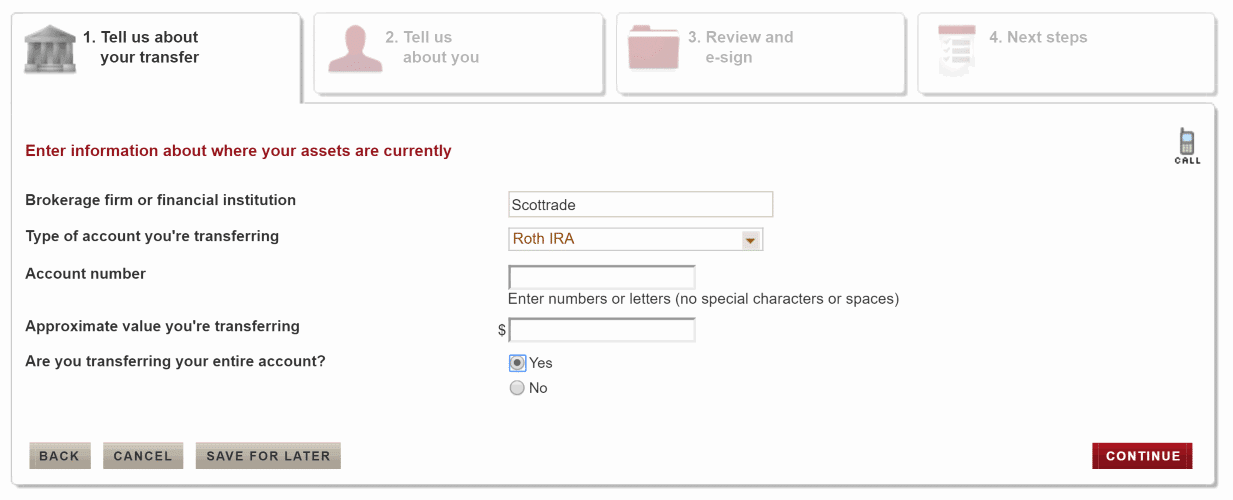

Fill out the form, entering the name of the firm (in this case “Scottrade”), the type of account, your account number, and the amount to transfer (which should be the whole amount).

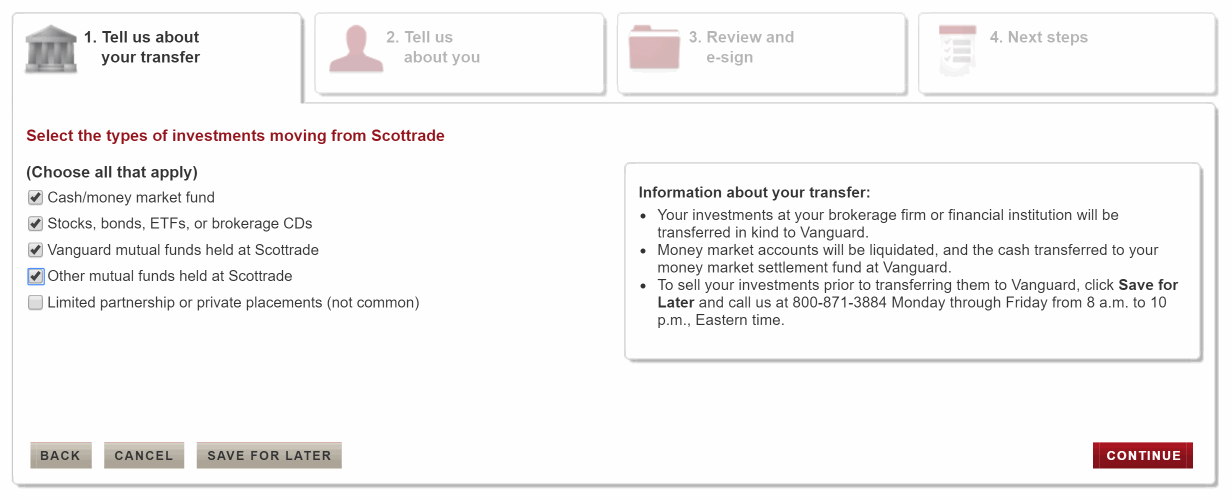

Check all the boxes that apply to your transfer. I checked them all just to be on the safe side.

The wizard then asks if you have an options contract. I had no such thing (this feels like it would be uncommon, but if you had this, you’d probably know), so I selected No.

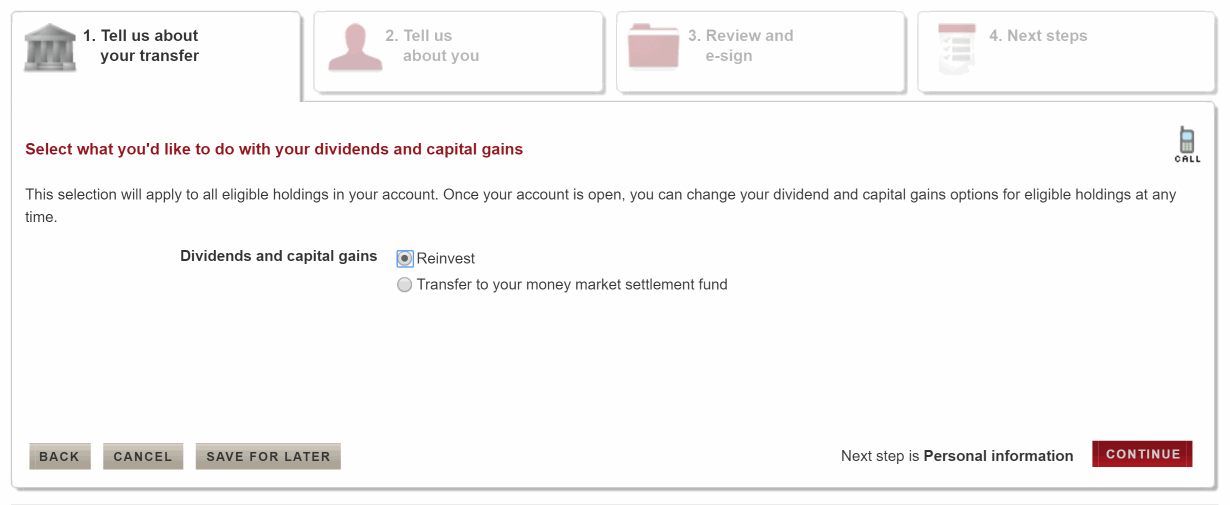

Select Reinvest dividends and capital gains. This is always always always a good idea. Your funds will often pay out a dividend, which is kind of like a return on investment, but we’re not interested in payouts here, so reinvestment will keep the money in the fund.

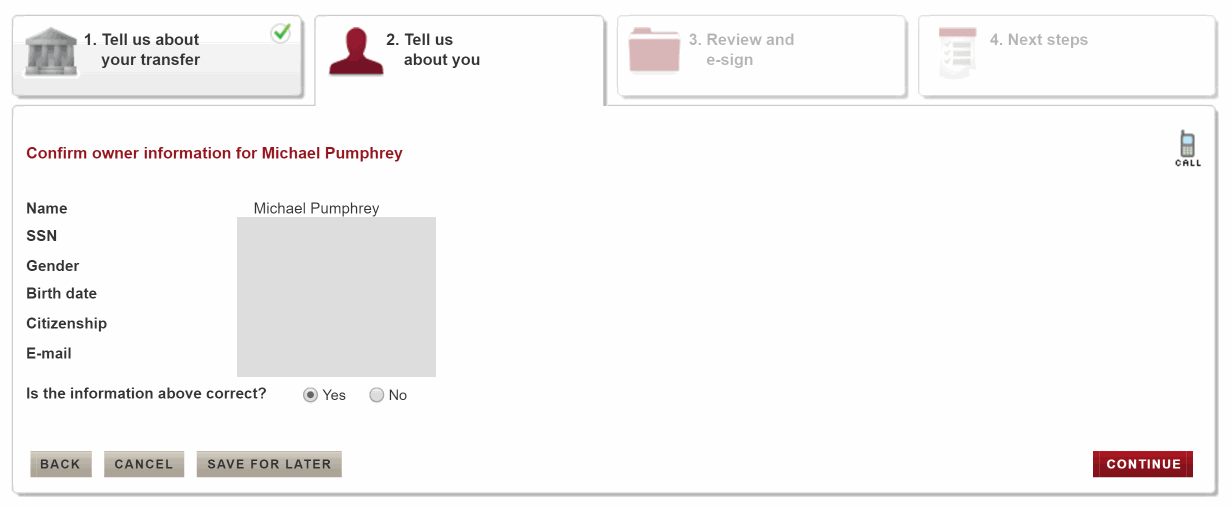

Confirm all of your personal info. Hopefully this should be the easy part.

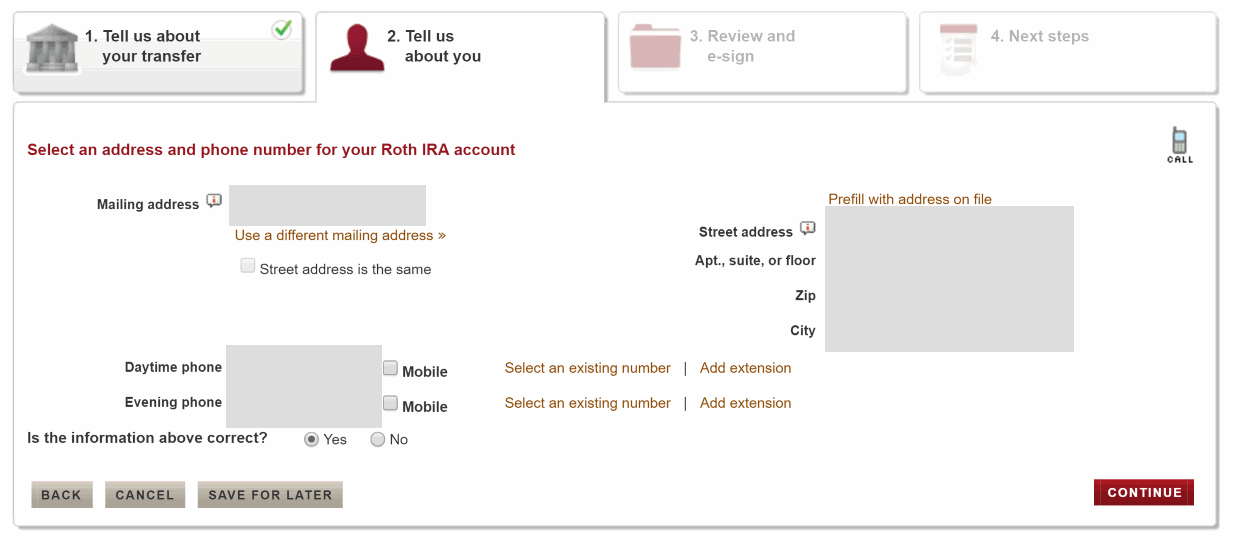

Enter address and phone number info for your new account.

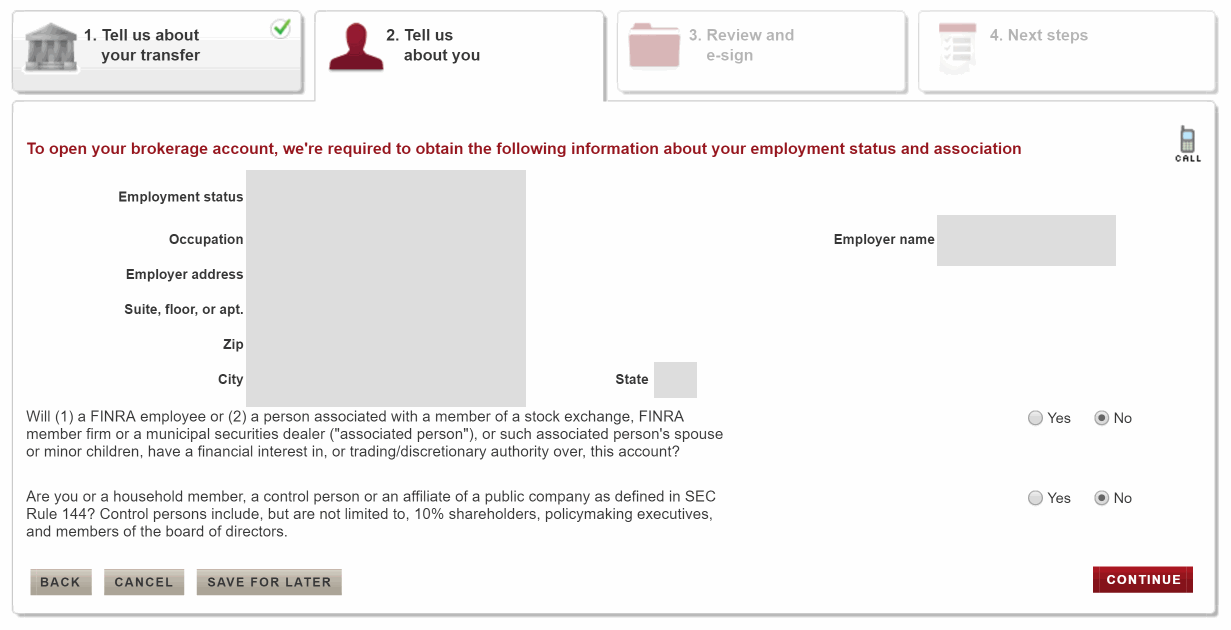

Enter employment information. Apparently this is required.

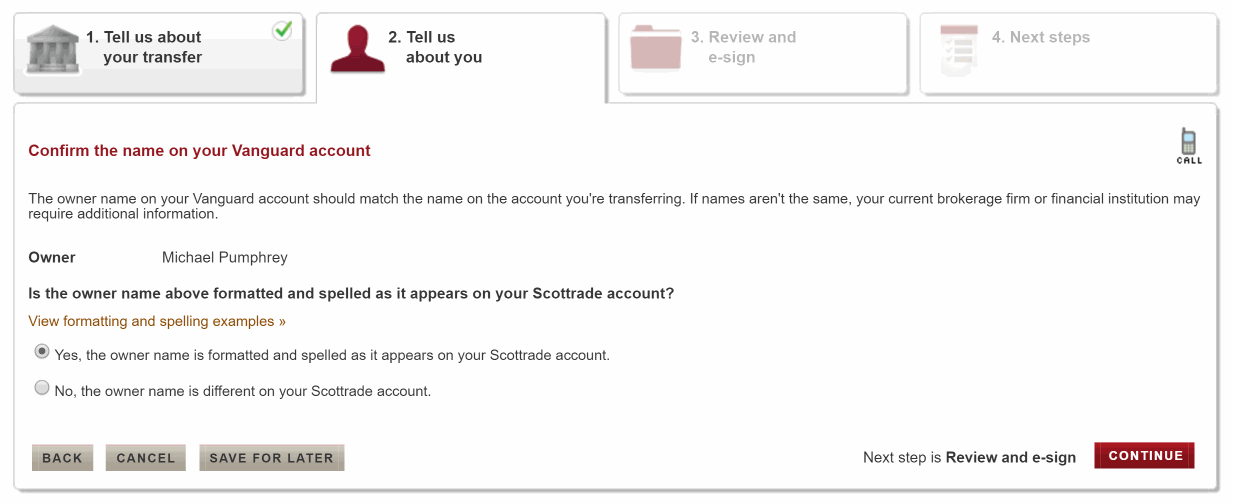

Confirm the name on your original account. Note that even though my Scottrade account listed my middle initial and my Vanguard account did not, I was still able to select Yes here, and had no troubles.

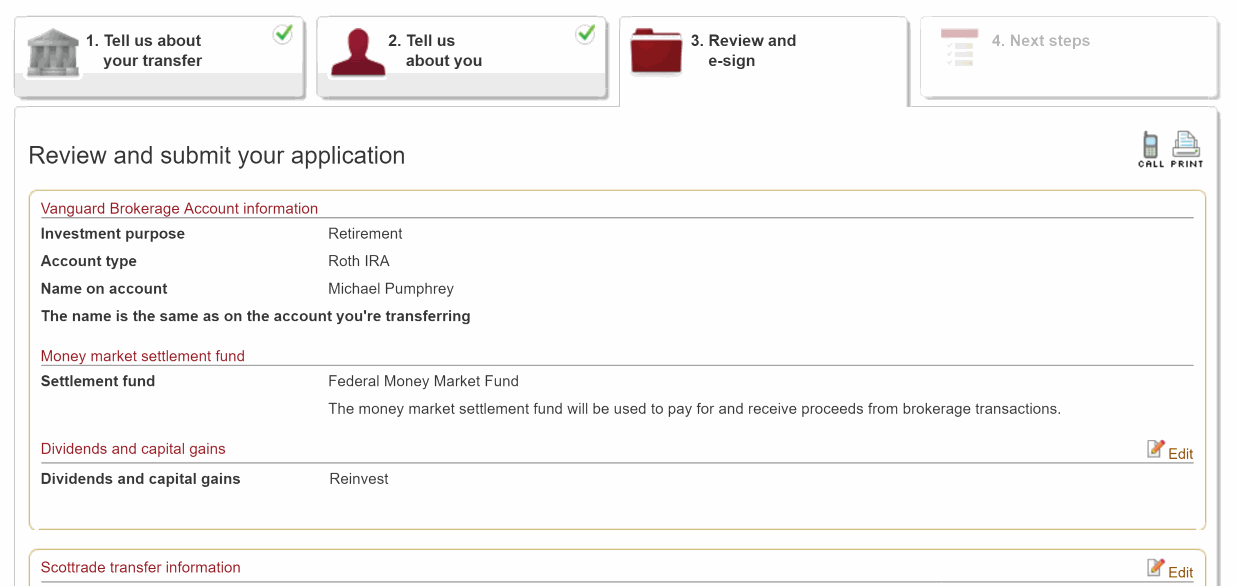

Now review the entire application and submit it.

That’s it! Everything else happens automatically. Here is the schedule of events.

I initiated my request on a Saturday, and my account was marked as complete the following Friday. The account at Vanguard contained a zero balance for a few days (which was a little stressful to be honest), but the funds showed up a few days after that.

The whole process was painless and easy, and didn’t require any more steps than what I have indicated here.

And now I have my old Roth IRA with Vanguard. Hooray!

Brokerage account?

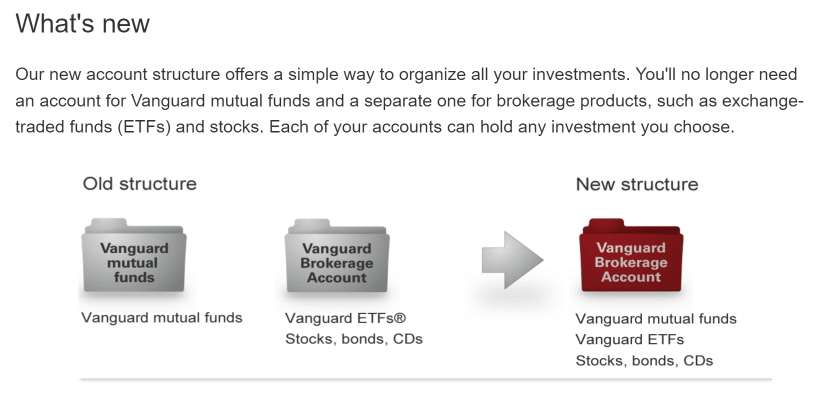

The one part that was surprising to me was that I was not opening up a normal account, but a “Brokerage” Roth IRA account. I was worried that this was somehow a different thing (that might incur different fees), but apparently, this is what all new Vanguard accounts are going to be, and as far as I can tell, all accounts will be converted to Brokerage accounts eventually. But the net effect is the same.

Scottrade is a fine institution, and I’ve had no problems entrusting my proto-IRA with them over the past decade or so. But it felt like the time was right to consolidate this account with my others, and thankfully the process was easy.

But enough about me. Have you transferred an account from Scottrade (or anywhere else) to Vanguard? What was your experience like?