I explore the process of doing a rollover of a 401(k) to an IRA at Fidelity Investments for the first time.

UPDATE: Added in details on whether you are rolling over pre-tax funds or Roth funds.

I’ve been taking a new look at Fidelity Investments recently, as a place to host my retirement accounts.

For years, I’ve extolled the virtues of Vanguard, and have written all sorts of information on how to interact with them, from how to open a Roth IRA to how to remove an excess contribution from said Roth IRA.

Recently, however, I’ve become more curious about Fidelity, and for two reasons:

- I’ve seen the customer service at Vanguard degrade over the years. For example, while trying to set up a Solo 401k with my partner, I found the experience simply awful, from both a customer service perspective and from a technical perspective. That soured me on Vanguard a bit.

- I had a really good experience with Fidelity recently during an IPO I got in on (long story, nothing exciting). Not only was the site easy to use, but I found phone support easy to get to and the people there were very helpful, something I haven’t been able to say about Vanguard.

All of this has made me think about how basically all of my retirement accounts are in Vanguard, and maybe that’s not such a good thing. Maybe, just as we diversify our funds in our accounts, we should also diversify our account holders.

And since I already had an account set up with Fidelity on account of this IPO thing, and since I had a 401(k) I still needed to rollover, I thought, maybe I should roll it over into Fidelity.

So that’s what I did.

If you’re looking to rollover a 401(k) into Fidelity, read on, and I’ll show you how it works.

Table of Contents

Create an account

The first thing you need to do in order to roll over a 401(k) to a Fidelity IRA is to create the account that will house the money you are rolling over. This account will initially have a balance of zero, but that’s okay.

1. Log in to Fidelity. If you don’t have an account with Fidelity, you can create one.

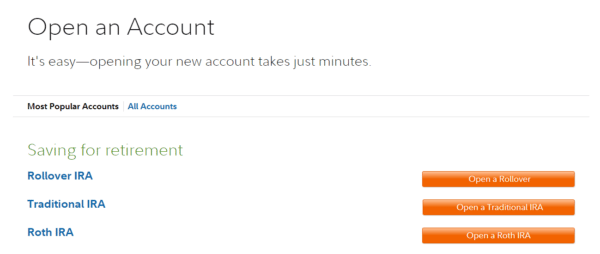

2. From the main dashboard, click “Open an Account”.

3. There are a number of accounts you can open. If your money was in pre-tax funds like a traditional 401(k), choose “Rollover IRA”. If you had Roth 401(k) or other post-tax funds, choose “Roth IRA”.

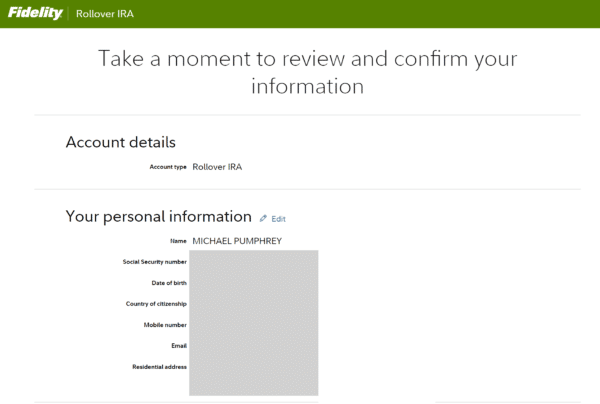

4. You’ll be asked to confirm some personal information and will be able to download a bunch of forms. Click “Open an Account” when done.

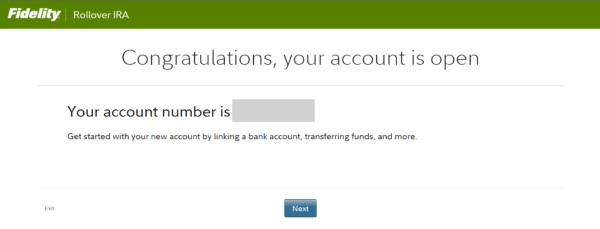

That’s it! You’ll be assigned an account number, and your Rollover IRA is ready to be funded.

Determine where to send the money

Your 401(k) account servicer (whoever it is) is going to need to know where to send the money. DO NOT SEND IT TO YOURSELF! You’ll be charged tons of fees and it’s not worth it.

You want to initiate a Direct Rollover.

This page shows the current address at Fidelity to give to your servicer. At the time of writing, it’s this:

Fidelity Investments, attn: Direct Rollovers

PO Box 770001

Cincinnati, OH 45277-0037

Initiate the rollover

The steps here vary based on where your 401(k) is housed.

For the servicer I used, here are the steps I took:

- Start the action entitled “Request Distribution”.

- Select the “Rollover” type of distribution, not the cash-out.

- Select the option “Mail rollover check to qualified retirement plan”

- Enter the account number provided by Fidelity, and the address to send the funds.

- Review and confirm the information. You’ll probably be sent a document to e-sign.

And that’s it again! It should take a few weeks for the rollover to go through.

Final thoughts

The process for opening a Rollover IRA at Fidelity is quick and easy, and I was very pleased with how everything went.

Regardless of what servicer you ultimately choose, Fidelity or Vanguard or somewhere else, the most important thing is to make sure that you keep track of all your retirement accounts at every job you have, and when you move on from a job, roll over the 401(k) into an IRA that you manage. These are your assets, and you’ll have more control over them with an IRA.

You’ll still have to buy investments with the money once it rolls over into your account. But that’s a topic for another time.