I discuss a skit from Square One Television involving a doubling allowance to show how our brains can’t grasp how compound interest works.

There are some random things that stick in a kid’s brain.

I remember a movie called The Peanut Butter Solution, about some kids who find a haunted building, lose all of their hair, and then make some concoction that accidentally makes their hair grow crazy long.

I remember a board game called Talking Football, which used little vinyl records to provide a randomized outcome to the game.

And I remember Square One, a TV show in the late 1980’s that was designed to teach kids about math.

About that last one, it particularly had an impact on me, as I’ve always loved numbers.

One of the things it taught me was how compound interest works.

I’ve been telling a story which was derived from one of these shows for years now. Now, I’m going to tell you where it came from.

Follow me back to 1987.

Table of Contents

Back to Square One

Square One Television was an educational children’s show that aired on PBS in the late 1980’s and early 1990’s. It was designed to promote mathematical literacy.

Yup, that’s right, it was a kid’s show about math.

But unlike Sesame Street, which just taught you how to count, this show went much deeper, talking about everything from combinatorics to the Fibonacci sequence.

It took the form of a sketch comedy show, like if Saturday Night Live was really into numbers.

I thought it was great. And while it was never the most popular show, there are those from my generation who still remember it fondly.

The doubling allowance

One particular skit stayed with me for over thirty years.

In a skit titled “Daddy Knows Different”, a father and son were discussing the son’s allowance.

In an attempt to trick the dad into giving him more money, the son suggested that he get paid daily, but with a difference: $0.01 on the first day of the month, then $0.02, then $0.04, and so on through the month.

Before I tell you the answer: How much do you think the kid would in total in a month, given this scheme? $5? $10? $50?

Well, watch the skit (it’s about 3 minutes long) and see for yourself.

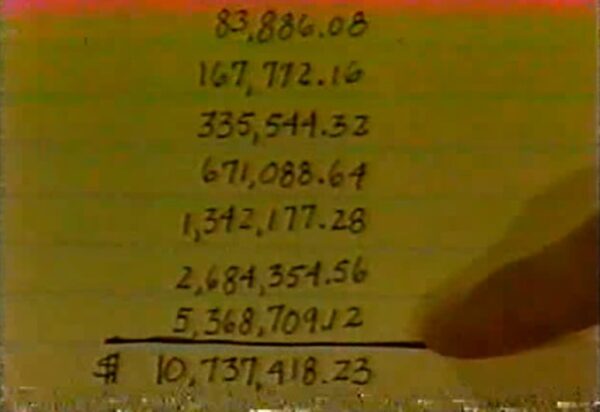

That’s right, by the end of the month, the dad would have paid the son over $10 million.

How could that happen? Mathematics!

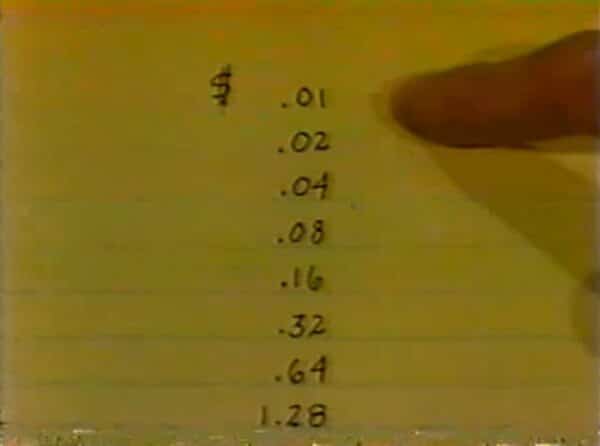

They helpfully show what happens when one cent doubles every day. It starts out small:

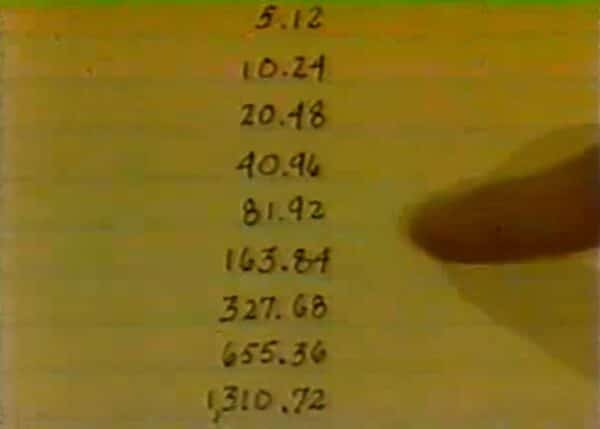

And then grows:

Until the end:

Wow. Sorry, Dad.

This shows the massive power of compounding returns, but more specifically it shows our brains’ inability to grasp how fast exponential growth really is.

Your investment’s compound interest

You probably didn’t imagine that the final number would be so high.

We don’t think that small returns over time will ever lead to big returns, but they do. And once they do, the returns stack up faster than you can imagine.

Now, the example used in the show is a daily return of 100%, which is unrealistic even by the standards of even by people touting crypto investing.

So what kind of returns can a reasonable person get with, say, low-cost index funds? There are a number of ways to calculate this, but for now let’s say 8% per year.

So, if we took $5,000 and let it sit for 30 years at 8%, here’s what would happen:

| Year 1 | $5,400 |

| Year 2 | $5,832 |

| Year 3 | $6,299 |

| Year 4 | $6,802 |

| Year 5 | $7,347 |

| Year 6 | $7,934 |

| Year 7 | $8,569 |

| Year 8 | $9,255 |

| Year 9 | $9,995 |

| Year 10 | $10,795 |

| Year 11 | $11,658 |

| Year 12 | $12,591 |

| Year 13 | $13,598 |

| Year 14 | $14,686 |

| Year 15 | $15,861 |

| Year 16 | $17,130 |

| Year 17 | $18,500 |

| Year 18 | $19,980 |

| Year 19 | $21,579 |

| Year 20 | $23,305 |

| Year 21 | $25,169 |

| Year 22 | $27,183 |

| Year 23 | $29,357 |

| Year 24 | $31,706 |

| Year 25 | $34,242 |

| Year 26 | $36,982 |

| Year 27 | $39,940 |

| Year 28 | $43,136 |

| Year 29 | $46,586 |

| Year 30 | $50,313 |

Now, notice that for the first few years, nothing really seems to happen. We don’t double our money for almost a decade.

But then, things really start to get rolling.

Of course, with your own investments, you’re not just putting money in today and stopping. You’re putting in a little bit, month after month, year after year.

At $5,000 each year, with 8% average annual return, after 30 years you’d have somewhere in the vicinity of $600,000.

So don’t tell me that small returns don’t add up over time.

It’s not quite an allowance that doubles every day, but I’ll still take it. Wouldn’t you?