Having children affects so many of your life’s financial decisions, but what changes for you if you are childfree?

Not every adult has children. And not every adult that doesn’t have children is planning on changing that.

There are many reasons for this. In the U.S., a lack of a financial safety net and the fears around climate change appear to be some reasons why many adults are foregoing having children. But even before that, access to contraception and rising living standards has meant that adults can choose to have the number of children they want, and they almost always choose less.

For others, having biological children may not be an option. And adoption is also a choice that some forego as well.

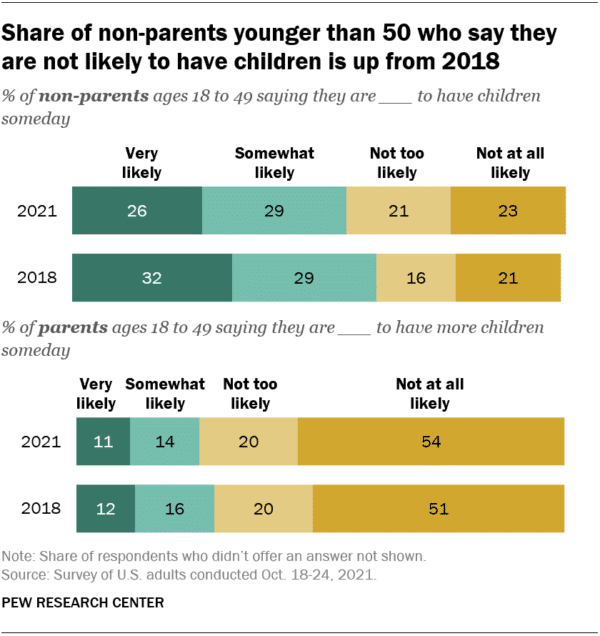

More people over time, by percentage, are choosing to not have children, according to surveys:

And the fertility rate in the U.S. (admittedly not the same thing) has been declining for decades now:

So, by choice of by chance (to borrow a slogan of The Not Mom, a community for women without children), many adults are not having children. You may be one of them.

If so, you may be wondering, how does this affect your financial needs? After all, most financial advice assumes that you’ll have kids. Indeed, one of Dave Ramsey’s 7 Baby Steps is specifically devoted towards children.

What happens when that is no longer relevant? Does that make things easier or more difficult?

Table of Contents

A financial planner’s opinion

A financial planner was interviewed recently for CNBC who thinks that the situation for childfree people is radically different.

[Childfree people] don’t need to build generational wealth, says Jay Zigmont, a certified financial planner and author of “Portraits of Childfree Wealth.” That renders much of the standard advice you hear from financial experts like Dave Ramsey moot. “If my nephews get $1,000 or $10,000 [when I die] that’s fine. If they get $1 million, I made a mistake, … Because either they could have used it earlier in life, or I could have used it.”

Zigmont goes on to describe eight “no-baby steps” (lol) that are specifically geared toward childfree people.

I confess I was pretty interested in this. As a childfree person myself, I was curious what someone with a CFP after their name had to say about my lifestyle from a practical, non-judgmental perspective.

But what I found wasn’t all that different or surprising. In fact, what was surprising was just how little really needs to change when you don’t have kids.

Are your savings goals different?

The guy starts out with pretty standard advice, stuff even Dave Ramsey and I agree on: get out of debt and build an emergency fund. Hard to argue with that.

But things take an interesting turn when he starts to talk about how one’s savings goals are different when you don’t have kids. From the article:

“[C]hildfree people may have very different landmarks. After all, there’s no child care to pay for, no college to save for, no inheritance to leave.”

And he’s right that if you don’t have kids, you don’t have to pay for child care (which in this country is monstrously expensive) or their future college attendance (ditto). This definitely frees up money that would have been diverted to these use cases. Childfree people for the win!

But already there are some assumptions brewing, such as that parents will help their kids with college. I knew plenty of people growing up who were on their own, some even with parents who were well-off.

And then we get to the “no inheritance to leave” part. The assumption here is that if you have money, you have to give it to your children. Not true. There are plenty of affluent parents not leaving their kids their fortune. You certainly aren’t obligated to do this.

And the reverse is true as well. Just because you don’t have kids, why can’t you still build an “inheritance”? What about nieces and nephews? What about charity? What about starting a foundation? Why are these seen as less-worthy causes?

Childfree people have the same obligations to save and give their money as people with children. They can—and should—build wealth to give away for the exact same reasons.

Is a house a choice now?

One thing that boggled my mind in this interview was the idea that when you don’t have kids, a house is not as important a financial goal.

A house is “a choice for childfree people, not a requirement,” says Zigmont — especially if you want the flexibility to move around.

Excuse me?

There are so many culturally-normative assumptions here that it’s hard to know where to start. First, why is a house (er, home) a requirement? Do the little tykes need a backyard to play in, lest they be sent down the dark path of evil in a big city?

I’ve already talked about the myth that people build wealth when they own a home (and that renters are at a disadvantage). It’s not true.

Children don’t change this. If you want to buy a home, do so. If you don’t (or can’t), don’t. Your children will be fine either way.

Your investment timeline

The article goes on to say that, without kids, your investment strategy might be different. You are now “free” to spend a little bit more money for the near term versus the long term.

What’s more, while you may want to invest for the long-term, you can divert some of the money to improve your life in the near future. “If your goal is to open a business, maybe you want to invest in that business, where the better answer financially might be to invest in the stock market,” Zigmont says.

Parents, screw your lives! Your purpose is to live solely for your children. Want to open a business? How selfish. You should have thought about that before you decided to breed.

Again, the assumption here is that parents need to put as the highest priority their children’s financial future.

Now, on one hand, I understand why this is. With wealth inequality being so rampant, generational wealth is, for many, their only hope of becoming wealthy. But the idea that you have to subsume your own needs and well-being so that your children may prosper in the future is a little hard to take.

And even Dave Ramsey, one of the most socially-regressive financial talking heads on the planet, puts college (Baby Step 5) after investing (Baby Step 4). From his book, “The Total Money Makeover”: “Some people want to invest less or none so they can get a child through school…I don’t recommend that because those kids’ college degrees won’t feed you at retirement.”

Better go start that business.

Who will take care of you?

You are responsible for your own end-of-life care, according to the article:

“Childfree people often get asked who will take care of us. The answer is my money, with the help of professionals,” says Zigmont.

And this is correct, though I think it’s also correct for those with kids.

Many parents believe that their kids will take care of them when they are old and in need. In fact, I think some people see their children as a kind of insurance policy.

But this, too, is an assumption. Your kids are not your nursing home service.

They may take care of you, and many do, but it is massively presumptuous (and disrespectful) to assume that they will be responsible for you. And it’s also short-sighted. What if your kids lack financial resources? What if they struggle with mental-health issues? What if they disown you and never talk to you again?

If you rely on your children to be your retirement plan, you’re risking a bad outcome.

So in this respect, childfree people and those with children have the same mandate to determine how they will be taken care of. And while some may decide to build shared communities with friends and like-minded people, for most of us, your insurance is your money.

More similarities than differences

Here are some other life situations that I read and thought, “this isn’t any different”:

- Long-term care insurance

- Disability insurance

- Intentional estate planning

The article concluded by saying that, without children, you are able to “‘[enjoy] your life…at a much earlier age,'” and that may indeed be true. Without the financial burden of child-rearing, there is simply one fewer (big) task on your plate, which means that you may be more able to reach your other financial goals quicker and with less difficulty.

But given that financial insecurity is practically our birthright as U.S. residents, I’m not really sure how much comfort that is.

Child-rearing, like everything else in life, should be a choice, one that we are all free to take or leave as we wish. In this way it’s not too different from deciding to seek a high-income versus pursuing more satisfying work at a lower pay. Our choices lead to consequences, and some of them are financial in nature.

We all have a mandate to work toward our own financial security, and once there—just like with airplane oxygen masks—we can then work toward the financial security of our community and those around us. Being childfree doesn’t change this mandate one bit, and given the financial resources not taken up by child-rearing, they may make all of this more achievable.