So the papers are signed and the move is complete. I’ll be living out of boxes for what feels like forever, but that doesn’t matter. I’m a homeowner now.

I’m also back into debt, as I have a mortgage now. Yes, it’s still a little nauseating, but that’s neither here nor there.

Now, a full year before I did this, I wrote about five reasons why I thought people couldn’t afford to buy a home. But as it was theoretical back then, it’s easy to grandstand and say whatever I wanted.

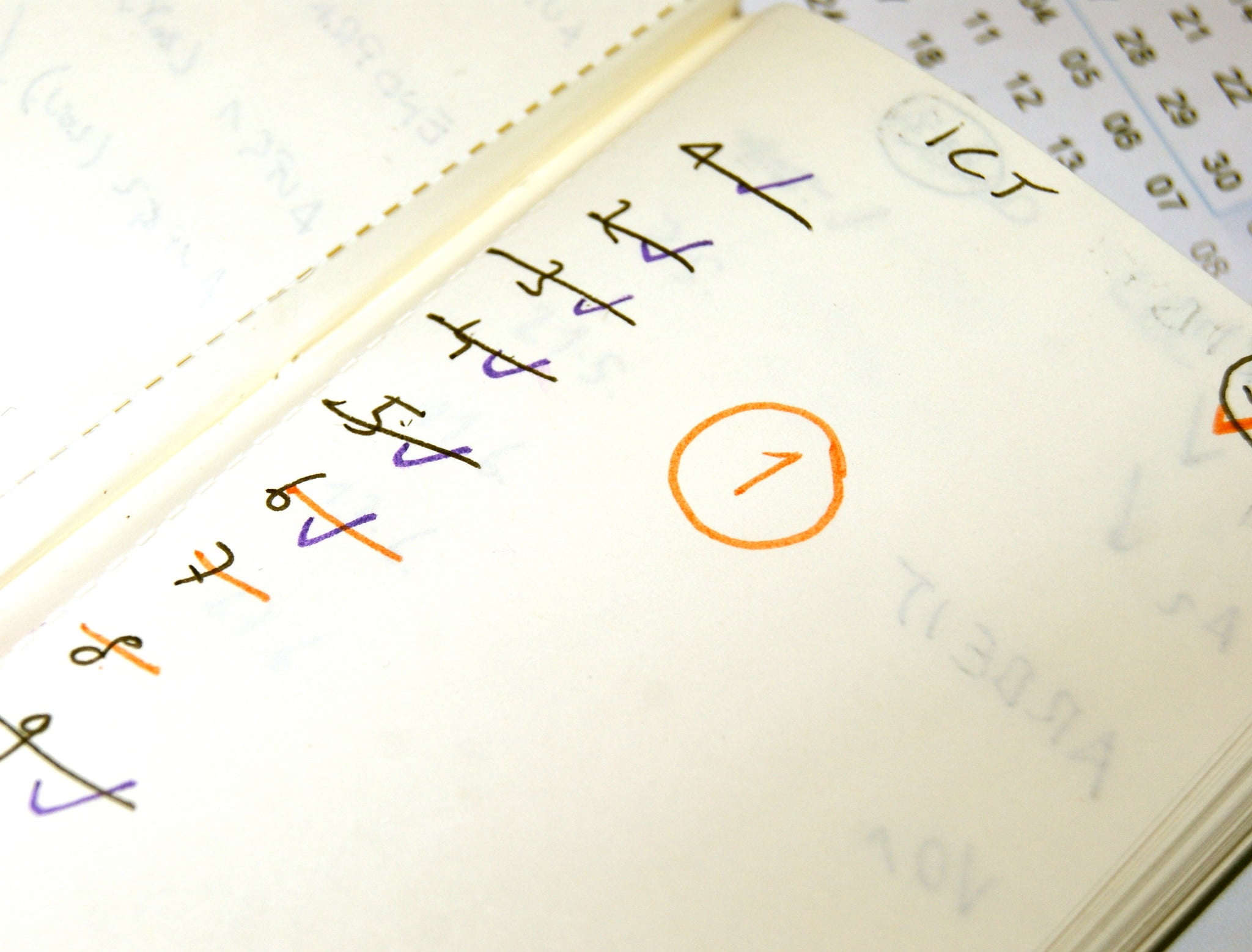

But now that it’s real, it’s time to look back and see how I did. Did I take my own advice? What grade do I give myself?

1) Have at least a 10% down payment (preferably 20%)

Grade: A

I put down 10%. I would have liked to have put down more, but I didn’t have it, and I didn’t think waiting (and moving again) would have made sense. Because I put down less than 20%, I have to deal with mortgage insurance (PMI), something I hope to be rid of very soon. Luckily, the PMI ended up being less than I expected it to be.

2) You can afford the home without external help

Grade: A

I received no monetary assistance for the purchase. In short, no one co-signed with me and I didn’t take out any loans for the down payment.

Now granted, being a product of a certain amount of cultural privilege, I’m not going to say that I never got any help. But when it came down to the actual purchase, I could do it on my own. Or at least I believe I can.

3) You can afford the payments on a 15 year fixed-rate mortgage

Grade: D

I’ve already sort of talked about this one a bit.

The issue isn’t whether one actually gets a 15 year fixed, but rather whether one can afford it. I’m not into the 30 year terms, because the amount you save per month isn’t very much compared to the amount you pay extra over the long term. I personally like the 20 year option much better.

In the end though, I went with the 25 year option, mainly to give me some flexibility. I could afford the 20 year one if I had wanted to go through with it.

I don’t think I could afford the 15 year though. And it makes me wonder whether if this was a realistic suggestion, or something that only works if you’re either very wealthy or live in super cheap places.

Or perhaps I should have held out for something cheaper, or waited until I had more income.

4) You have a full emergency fund

Grade: B

I define a full emergency fund as six months of bills and expenses in savings.

Prior to the signing, I had this covered, but as soon as I signed, my payments went up, so I no longer had the whole six months. Which is why it’s important to reevaluate your emergency fund when your spending changes.

This is something I will be working on building back up over the next months.

5) You are able to contribute to a “home fund”

Grade: ?

I bought a condo, which means that some of the home fund is automatically deducted in the form of HOA fees. So by definition, I have to contribute to a home fund. Anything beyond that is too early to tell, as I’m still learning what I’m on the hook for and what the HOA is on the hook for. That will determine how much I need to put away relative to how much I have.

Final score: B

I’d say that’s not bad for my first time. Maybe I can get my grade curved a bit for being totally out of debt aside from the mortgage. Either way, it’s a result I’m happy with.

But enough about me. If you’ve been in a situation like this, how would you grade yourself?