The parable from the Dave Ramsey team about Ben and Arthur is fatally flawed, which is good news for pretty much everyone.

Everyone knows that you should start saving for retirement early.

And that makes sense. The sooner you start, the sooner you can build up some serious funds.

Remember, the simplest way to be able to afford retirement is to be able to have enough money put away such that you can live off that money’s interest. (This is where The 4% Rule originally came from.)

But easier said that done, right? I know plenty of people in their 30’s, 40’s, and even 50’s, who haven’t saved anything serious towards the future. In fact, the median retirement balance for those aged 45-54 is only $90,000.

One rather famous example (in financial circles) that showcases the importance of starting early comes from Dave Ramsey, and it showcases the story of Ben and Arthur. These two folks both save for retirement, but they both do it in very different ways.

This story might be stress-inducing for you, but fear not, as it has a happier ending than you might think.

Table of Contents

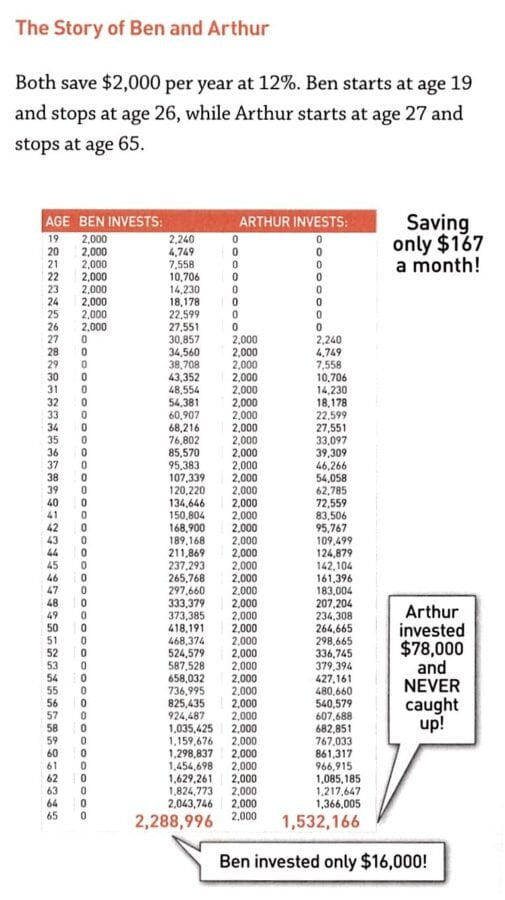

The story of Ben and Arthur

This story talks about two people, Ben and Arthur, who are saving for retirement.

Ben starts saving for retirement at age 19, putting away $2,000 each year for eight years, after which he stops saving any money for the rest of his life. I don’t know why; maybe he decided to to move to an ashram in India or something. Either way, he’s done.

Meanwhile, Arthur doesn’t start saving for retirement until age 27, which is a little closer to you and me than that upstart Ben. And he continues each year, diligently putting $2,000 in a retirement account until age 65.

So Ben invested for 8 years, and Arthur invested for 39 years. How did they do?

The way the story is told, Ben ends up with $2,288,997, while Arthur only ends up with $1,532,183, even though Ben stopped investing at age 27 and Arthur put in almost five times more money than Ben.

The goal of this parable is to tell you that you should move to an ashram, er, that early investing matters so much more than later investing.

But like most of these types of “helpful” tips, it’s more likely that it’s going to make you panic and tell you that it’s too late. After all, how many people learn Ben and Arthur’s story while still being young enough to mimic Ben? Any hands out there? Didn’t think so.

Not so fast

But the picture isn’t as grim as it sounds for all of us Arthurs, because there is one serious assumption being made here.

The assumption is that both Ben and Arthur make an annual return of 12% on their investments.

This is, shall we say, a tad unrealistic.

Sure, it’s possible to make 12% some years, with some investments. And in other years, you could even make a lot more.

But there is no widely-available investment that has made a reliable 12% year-on-year return over a 40 year period. Anyone who claims otherwise is either misinformed or Bernie Madoff.

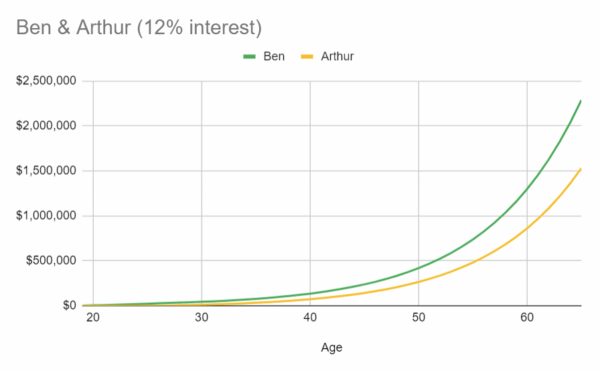

How interest rates affect Ben and Arthur

Interest rates are the key factor here in the story of Ben and Arthur, because of the outsized influence of compound interest.

Ben doesn’t put in a penny to his investments (as he has been on a silent meditation in the outskirts of Darjeeling) for almost 40 years, and yet his balance at the end is 143 times his input. That’s the magic of compound interest.

And by picking 12%, the wizards at Ramsey Solutions have been able to make a powerful case, because at that rate, Arthur will never overtake Ben.

But out here in the real world, where interest rates are lower, the situation is different.

Ben and Arthur and the S&P 500

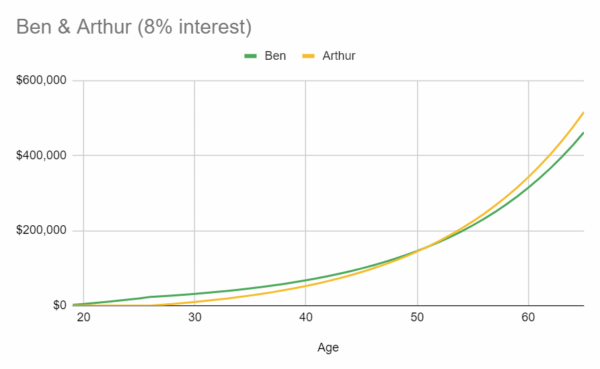

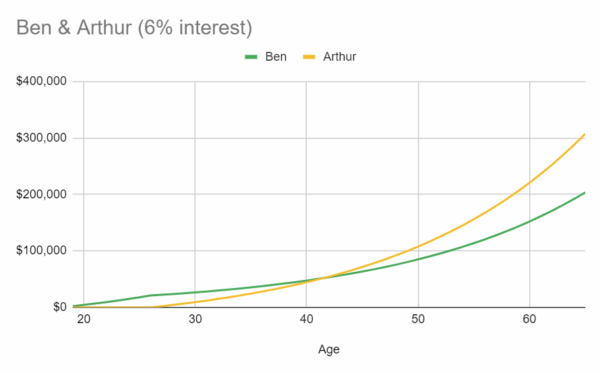

The long term average annual return of the S&P 500 is around 8%, after accounting for inflation.

So let’s see what happens when we apply this rate to Ben and Arthur.

Ben still makes out well, putting in $16,000 total and earning a grand total of $462,151, while Arthur, ever the laggard, put in the same $78,000 as before, but ends up with $516,113, eking out a win against Ben.

If you wish to invest more conservatively, with lower interest rates (say 6%), Arthur overtakes Ben much more quickly.

Does it matter how much Ben and Arthur invest each year?

What if we were to adjust the yearly amount that they both invest?

Well, it turns out that that won’t affect the race, only the total amounts. Ben and Arthur will still be at the same position, ahead or behind, no matter what the yearly amount is.

What matters here is the interest rate, not the amounts.

Takeaway

But it’s that yearly amount that turns out to me much more key than anything else in this story. Because the difference between $2,000 a year and $5,000 a year in Arthur’s story is the difference between $516,113 and $1,290,283, a hefty difference indeed (at 8%).

If you can up that yearly amount to $10,000, Arthur makes out with a significant $2,580,565.

And that, I think, is the more useful takeaway from this sordid affair. Yes, it would be great to invest earlier in life. But if you can’t, or if you didn’t invest earlier in life, you still have an opportunity to catch up and make a sizable return. And the more you put in, the more you get out.

So while the story of Ben and Arthur is a fun “gotcha”, it isn’t a realistic scenario for anyone and so shouldn’t be taken too seriously. A slow and steady investment tactic will net you the most money over the long term.

Ben won’t come out ahead if he stopped investing at 27, and neither will you. Not that Ben cares, of course. He long ago disavowed the material world.