A report on employees worrying about money at work suggests that employers should offer financial wellness as an employee benefit. I can help.

Are your employees worrying about money?

The answer is probably yes. If everyone wasn’t already worried, the pandemic probably hit people sideways in some way. I know it certainly has for me.

This worry can manifest itself in a number of different ways. It can result in sleepless nights, fights with a partner, and even distraction at work.

And it’s that last part that I want to talk about today. Because it turns out that worrying about work isn’t just a distraction for employees, but as a business owner, it can affect your bottom line too.

It’s kind of like a lose-lose situation. Let’s fix that.

Table of Contents

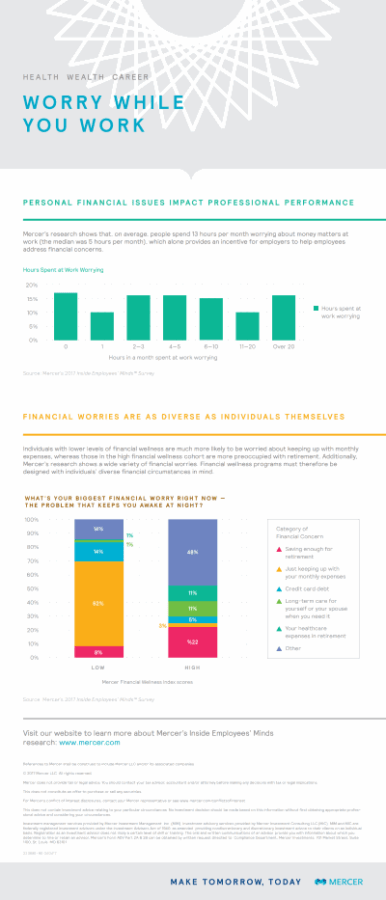

Worry while you work

I recently came across a report from the American asset management firm Mercer about financial worries at work.

Called Worry While You Work, it’s a short report, more of an infographic than a missive, but its content caught my eye.

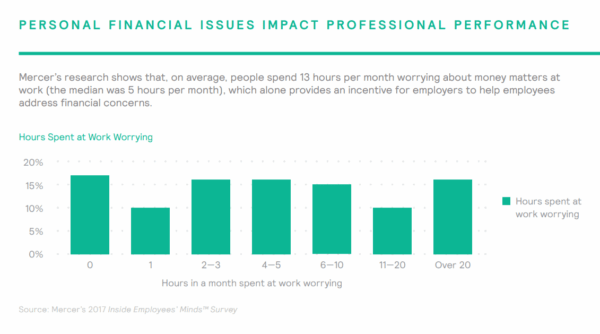

Here’s a closeup of the top graphic:

Here are some takeaways from this chart:

- 83% of workers spend some time at work worrying about money.

- More than a quarter of workers spend more than 10 hours a month worrying about money.

- 16% of workers report spending more than 20 hours a month worrying about money.

Or, more prosaically:

People are really frikkin worried about money.

In search of lost time

Let’s just step back and think about this.

How many hours in a month does one work? If you assume 20 business days, and assuming the standard 40 hours a week, that’s 800 hours of work in a given month.

From this, we can restate some of the above points to as follows:

- More than a quarter of workers spend more than 1% of their total working time worrying about money.

- 16% of workers spend more than 2% of their total working time worrying about money.

Now, 2% may not seem like a lot, but if you sum over all employees and over each and every month, that is thousands of hours of lost productivity, and millions (if not billions) of dollars of lost revenue for a company.

If I were an employer, I’d be incensed by this. And I’d want to respond, not by reprimanding the employees of course, but in protest of the system that causes so much financial distress.

And I’d ask myself: am I part of the problem, or part of the solution?

What I’m doing

It’s for this reason that I’ve decided to branch out into offering financial wellness seminars and coaching for companies and their employees.

I’ve come to this conclusion for a number of reasons:

- Employers should be able to offer financial wellness to their employees in multiple ways, not just a paycheck.

- Many businesses, especially those in the non-profit or lower-wage sectors, may not be able to compensate their employees as effectively as they want. Teaching financial wellness in this way can help bridge this gap.

- People are used to getting benefits from their employer: A 401(k), a 24 hour nurse hotline, maybe a gym benefit. Financial wellness fits in squarely with these other perks.

- More to the point, many people cannot pay for financial wellness benefits like my coaching services. But an employer is more likely able to accept the expense.

And it’s that last point that I want to leave you with. An employer that offers a financial wellness benefit to its employees benefits just as much as the employees do. Because an employee that’s able to be more confident and empowered into their personal financial situation is going to be less worried about money.

And as this report shows, that’s likely to lead to greater productivity, and fewer hours lost at work to worry. How much is that worth?

If you are interested in learning more about my offerings, please see my page on wellness training, or send me a note. Let’s turn that lose-lose situation into a something better for everyone.