I recently decided to find out what was on my credit report. I figure, if my permanent record is going to follow me around, I might as well know what it says about me. And perhaps a nefarious Mike with a mustache is going around using my identity to get credit cards and rack up thousands of dollars of purchases. And then not paying for them.

It wasn’t as easy as I expected it to be.

Table of Contents

The first one’s on us, kid

I logged on to annualcreditreport.com, and went to request my report. As I hadn’t done this in over a year, I had access to all three reports from the three major credit reporting agencies.

First up was TransUnion. I was asked a few pertinent and easy-to-verify questions (to ensure that I wasn’t Mike-with-a-mustache) and then was given my report to viuew and download.

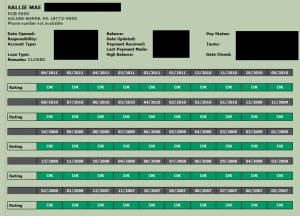

The report was surprisingly large, consisting of every account that I’ve had in recent memory, as well as my status on them, every single month dating back all the way to 2002. (!) I looked around for any evidence of late payments or outstanding balances (neither of which I have), and was relieved to find none. So no errors as far as I could tell.

I downloaded the report so I could refer to it later, and went to the next agency: Equifax.

You thought this would be easy, kid?

Equifax took a decidedly more cautious approach with me. It asked me verification questions like TransUnion did, but these were different. These were hard. Now, I’ve got a good memory for these types of things, but the questions they asked felt almost unverifiable.

For comparison, TransUnion asked me questions like:

What street have you lived on in the past?

- Some street I’ve never heard of

- Some street I’ve never heard of

- Some street I’ve never heard of

- Some street I obviously lived on

But Equifax asked questions about a student loan. From 2006. That is eight years ago, in case you’re reading this in the future.

Here is approximately one of the questions they asked:

What was your monthly payment on this loan?

- $0-$24

- $25-$49

- $50-$74

- $75-$99

Were they kidding me? They were asking me to remember how much my monthly payment was on a loan that I had paid off years ago? And those options were so close together. How did I know whether it was $74 or $76?

It felt like I was being asked the following:

How much of the world is covered by ocean?

- 70 percent

- 71 percent

- 72 percent

- 73 percent

You see what I mean? You know the answer approximately, but you don’t know the answer exactly. And that’s fine! Except not, apparently, to Equifax.

Now, the irony, of course, is that I’m probably one of the only people who actually has access to this kind of information. I have budgets and spreadsheets going back at least to 2003, when I moved to New York. But I’m an anomaly, and I know this. Most people don’t have financial records going back a decade. (Though now’s a good time to start.)

So, with the best of intentions, I answered as if I didn’t have direct access to the answer. (I did it for you; you’re welcome.) The response was immediate; I was denied, not allowed to see my credit report. I would need to physically mail in a request, with blood sample and money order made out in Spanish Doubloons.

Which led to an interesting thought: Does a failed attempt to access your credit report go on your credit report?

This isn’t a game, kid

A bit shaken by this, I continued on to credit report #3: Experian. This time, I was determined to get all my questions correct.

Success! I received access to my own credit information. (Thanks, I think.) Once again, I pored over the information on the report, looking for red flags or things that looked unfamiliar. Thankfully, once again, I found nothing.

So I’m relieved I didn’t need to go through the (surely exciting) process of disputing anything on these reports. I am still a bit shaken by the Equifax experience, and am wondering if they have flagged my account. That would be highly strange, to be flagged for lacking an encyclopedic knowledge of my own credit history, when the whole point of engaging with them would be to get exactly that information.

Then again, maybe it’s not worth the trouble to investigate. After all, credit isn’t very important to me. And also, I’m a bit low on Spanish Doubloons.

But enough about me. What happened when you went to access your credit report?