Mutual funds have been lowering their fees for years, and Fidelity has overtaken Vanguard with their line of funds with zero fees.

I’ve been a fan of Vanguard for a long time. They have always been focused on lowering prices for people like us. After all, they invented the index fund, the low-cost mutual fund that allows you to track a market index without having to pay a fund manager. It’s brilliant, and it works.

Before index funds, I’ve read that average expense ratios were upwards of 1-2%. That means that you paid a 1% or 2% fee on your invested money. When you’re making between 4-10% returns, that’s a huge penalty!

Vanguard has consistently pushed the cost of owning their mutual funds (expense ratio) down and down and down. And these days, some of their mutual funds are now an astonishing 0.04%.

To put that in context, 0.04% of $10,000 is $4. That’s nothing.

So we’re ready to crown Vanguard the lowest cost mutual fund, right?

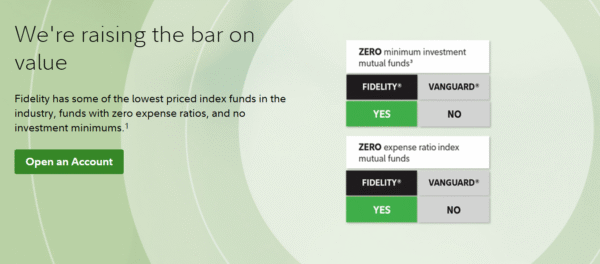

Not so fast, because Fidelity now offers mutual funds with 0% fees. Zero. Zilch.

How in the world can this work? Let’s break it down.

Table of Contents

Fidelity ZERO

Fidelity is a brokerage firm that, for our purposes, is more or less in the same camp as Vanguard. You can open IRAs, 401(k)s, and brokerage accounts just like you can with Vanguard.

And like Vanguard, they have their own versions of the same types of index funds.

Vanguard has a Vanguard 500. Fidelity has a Fidelity 500.

Vanguard has a Total Stock Market index fund. Fidelity has a Total Stock Market index fund too.

But then, Fidelity came out with their Fidelity Zero (actually “ZERO”, all caps) line of mutual funds.

These are funds you can buy that have no expense ratio. None at all.

So a $10,000 fund would have $0 in fees. Nothing but growth, right?

There are four funds that Fidelity has under the “ZERO” category:

- Fidelity ZERO Total Market Index Fund (FZROX)

- Fidelity ZERO Large Cap Index Fund (FNILX)

- Fidelity ZERO Extended Market Index Fund (FZIPX)

- Fidelity ZERO International Index Fund (FZILX)

How can they do this?

Expense ratios are a primary way that brokerages make money when you invest. So if you’re wondering how Fidelity can make money without them, you’re right to wonder.

In the short term, as far as I can tell, they don’t.

But they also don’t necessarily need to.

Running one mutual fund is expensive. But it isn’t that much more expensive to run 505 mutual funds instead of 504 mutual funds, especially if the 505th fund is an index fund. Fidelity, being one of the largest asset managers in the world with more than 69 million customer accounts, already has the infrastructure in place to handle another customer (or a million of them).

Also, this is clearly meant for you to get in the door. Since you have to have an account with Fidelity to buy these mutual funds, the idea is that you’ll eventually purchase other products from Fidelity (that do have a fee). If you open an IRA, say, to purchase these mutual funds, then you’re probably going to purchase other mutual funds, or ETFs, or even straight stocks and bonds.

Once you have the account, it’s probably sticking around.

In that way, these products act as a “loss leader”, not unlike cheap eggs at the grocery store, or the way Radio Shack used to have killer deals on batteries.

How much do you save with a free mutual fund?

To determine how much you save putting your money in one of these funds depends on what you would have put your money in otherwise, all other things being equal.

Let’s take the mutual fund Fidelity ZERO Total Market Index Fund (FZROX), which is an index fund that seeks to track a broad range of U.S stocks. The closest equivalent would be Vanguard’s Total Stock Market Index Fund (VTSAX), whose Admiral Shares have a 0.04% expense ratio.

Comparing the returns of the two mutual funds over the past five years, it looks like Fidelity’s fund returned 14.22% average annual return, while Vanguard’s fund only returned 14.03%.

That means that $10,000 invested in Fidelity would become $19,441 after 5 years, while Vanguard would return $19,279, a difference of $162.

Okay, not nothing, but not exactly a big difference.

A great marketing scheme

Ultimately, this is a great marketing scheme, and not much more than that.

The race to the bottom when it comes to fees for investing has basically ended. Whether we’re talking 0.04% or 0.00% isn’t really all that material, not when we’re dealing with the sums that you and I are likely to have. We’ve certainly come a long way from 1-2% fees.

So if you’re looking to open an IRA or brokerage account, and want the absolute lowest fees possible on these types of mutual funds, then absolutely open an account with Fidelity.

But if you already have an account with, say, Vanguard or Schwab or wherever, there is absolutely no reason to move your money. Stay where you are, and you’ll earn great returns over the long term long as you’re invested in low-cost index funds. And who knows? Maybe Vanguard and Schwab will eventually get into the 0.00% game.

But if they don’t, it will hardly matter.

What to do instead

Much more important than where you park your money is that you’re parking it at all.

If you’ve eliminated (or just significantly reduced) your debt, you want to start putting money away into tax-advantaged accounts like a Roth IRA or 401(k) as soon as possible. You need time for that money to grow. Short of hitting the lottery (which, don’t), I don’t see a clear path to wealth or financial stability for most people without putting your money in some form of investment account.

And if you have debt, did you know that paying down your debt is financially equivalent to investing money at the exact rate of your debt? So by paying down a 15% credit card, you’re actually getting a 15% return in terms of interest not paid.

So keep striving.