Think you have to use credit cards to get miles and points? Think again. Here’s how to do it without using credit cards.

One of the most reflexive ways that people use credit cards is to “earn points”. Meaning, they put everything on a credit card in order to earn as many travel points (or airline miles) as possible.

This can get many people into trouble; best case, they have no idea whether they’re spending more than they have, and worst case, they rack up a bunch of credit card debt.

When you use a credit card, you’re not actually paying for things; you’re making a promise to pay for it later. And if you don’t have the money later? That’s not the credit card company’s problem; they’ll just charge you interest on the money you don’t have.

Now, don’t get me wrong, I love travel points and miles. I flew to Japan in business class last year with my partner, and I used miles to get there. I could have spent $8,000 per ticket, but instead I redeemed 60,000 miles. I think that was the better deal.

But I recommend you not use credit cards for everyday spend, at least if you care about financial wellness.

Luckily, there are plenty of ways that you can earn boatloads of points and miles without ever using a credit card.

Table of Contents

Airline shopping portals

Most airlines have a shopping portal, a way to click through to a shopping site, which will then track your purchase. By going through the portal, you can earn points and miles, depending on the merchant and the portal.

For example, here’s Alaska Airlines’ shopping portal.

I’m looking just at the top points earners, and you can earn 4 points per dollar at Adidas, 4 points per dollar at Best Buy, and 3 points per dollar at Home Depot.

So just buy what you were going to buy anyway, and you’ll earn points and miles. And note that nothing about this requires a credit card.

Or try some other airline portals:

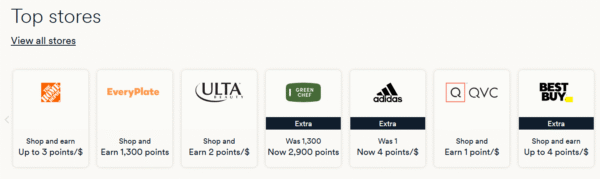

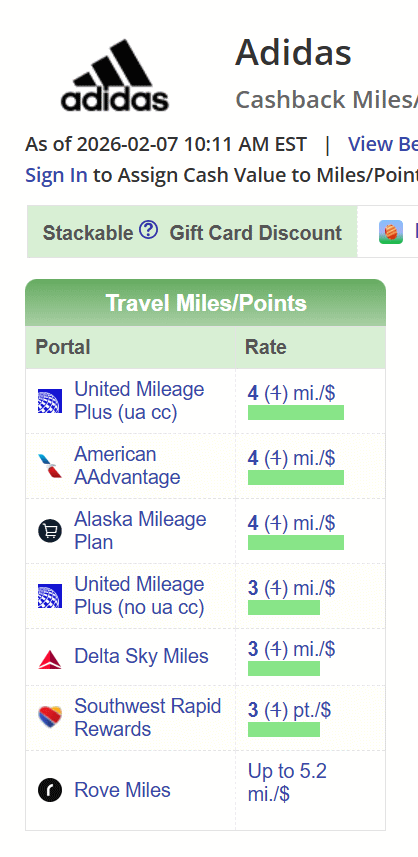

Cashback Monitor

A quick plug here. Sometimes it’s hard to know which site will earn the most points.

For this, I offer you: Cashback Monitor.

It’s a site that looks at all the different portals and tell you which ones will earn what from which merchant.

For example, here’s Adidas. It notes that not only can you earn 4 points with Alaska, but also with lots of other airlines as well.

If you take nothing else away from this article, bookmark this site.

Dining rewards

Every airline has a dining rewards program. There are certain restaurants that are part of the dining network, and when you dine there using a card that you’ve registered with the program, you earn points.

This can potentially be lucrative if you eat out a lot at places that are part of the network.

And it doesn’t require a credit card either. You can link your debit card just fine.

This one sometimes surprises me with unexpected points, especially when I travel and go to a restaurant that I didn’t know was part of the network. But since I had my debit card registered with the network, I got the points all the same.

Register here (but you can only use one):

Other tie-ins

You can find points tie-ins in a few different places if you look.

I get a handful of Alaska points every time I take a Lyft. And I’m pretty sure I used to get some points when I did DoorDash, though I’m pretty sure that doesn’t exist anymore.

Either way, look around; you might find some more options like this.

Bilt Rewards

Bilt Rewards is a unique case. Its big selling point is that you earn points through them when you pay rent, though they have other earning opportunities too.

They have a credit card, and of course want you to sign up for them, but I think you can still earn points on your rent without a credit card in some cases.

I have a mortgage, so I don’t use Bilt for this particular feature, though it is intriguing. Use at your own risk, of course.

Fly

I know this should go without saying, but you can earn lots of airline miles and points by flying.

I’m loyal to Alaska Airlines, but they are good to me in return. My particular elite status level gets me a 50% bonus on miles flown. So a 6,000 mile round trip earns 9,000 miles. That adds up quickly.

I know it’s a valid strategy to just go with the lowest priced airfare on whatever airline, and I don’t begrudge you if that’s your strategy. But sometimes, if you can bunch up all your miles with one airlines, it can pay to be loyal.

Credit cards

Okay, this might seem a little contradictory. Didn’t I say not using credit cards?

Correct, I said not using credit cards. But I said nothing about having credit cards and not using them. I think having credit cards and not using them is a perfectly valid strategy for earning rewards.

There are some credit cards out there that give you a certain number of points (usually hotel points) every year just for having the card. These usually have an annual fee, but the amount of value you get from the points almost always is greater.

I’m not linking to credit cards on this blog, but you can do your research.

You can earn miles and points without using credit cards

Many people think that you have to use credit cards to earn travel miles and points. Not true at all. I earn tens of thousands of miles and points every year without putting spend on credit cards.

And if you want to learn how to redeem your points better, I have a guide here.