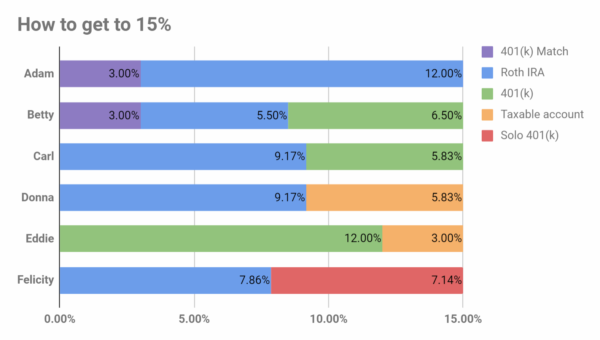

Save 15% for retirement. You’ve heard it all before. And now you know how you determine how to determine which investment vehicles comprise that 15%.

But with so many different options and scenarios, it’s easy to get lost.

So here are six, real-enough examples showing common cases, and a suggested way to divide up that 15% for optimal results.

Everyone, meet Adam, Betty, Carl, Donna, Eddie, and Felicity.

Table of Contents

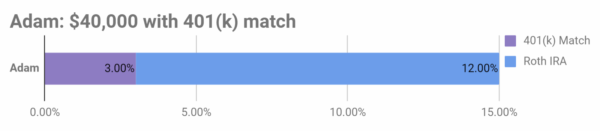

Example 1: $40,000 salary with 401(k) match

Adam has a good job with a medium-sized employer. He makes $40,000. His company offers a 401(k), and offers to match up to 3%.

How should Adam invest his 15%? 15% of $40,000 is $6,000, so that’s what he has to work with.

The best option Adam has is that 3% match. Seriously, it’s free money.

So he invests his first 3% ($1,200) in his 401(k) and gets a 100% return on that money, regardless of what he invests in.

His next best option would be a Roth IRA. A Roth is awesome, better in many ways than a Traditional IRA. I think a Roth IRA is a better use of your funds than a 401(k).

So Adam would put his remaining 12% ($4,800) in a Roth IRA.

Here’s the graph of how that 15% is made up:

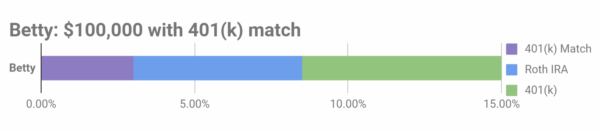

Example 2: $100,000 salary with 401(k) match

Beth is doing quite well for herself, making good money, and with a company that offers the same 401(k) and 3% match.

15% of $100,000 is $15,000. What does Betty do?

Well, again 3% ($3,000) goes to the 401(k) match to start.

From there, again, a Roth IRA is the next best idea. But there’s a problem. She has $12,000 left, but a single person can only contribute $5,500 per calendar year. So she’ll max out the Roth IRA, and still have $6,500 left to allocate.

In that case, she returns back to the 401(k). It’s not as good as a Roth for lots of reasons, but it’s still a tax advantaged investment (pre-tax contributions). She puts the remaining $6,500 toward her 401(k), and then she’s done.

(If she had had the option of a Roth 401(k), she could do that instead.)

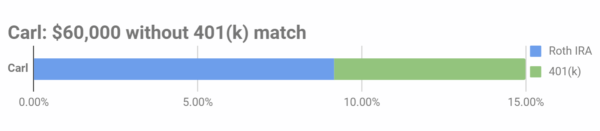

Example 3: $60,000 salary without 401(k) match

Carl is moving into his prime earning years. His company offers a 401(k), but doesn’t offer a match. Does that affect his choice when compared to Adam?

Indeed it does. Because a 401(k) match is far superior to just investing in a 401(k). So he would start out with the Roth IRA and then move to the 401(k).

15% of $60,000 is $9,000. So he maxes out his Roth at $5,500 for the year, and then devotes the rest ($3,500) into his 401(k).

Here’s the graph:

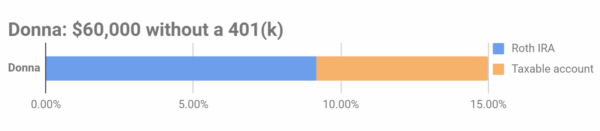

Example 4: $60,000 salary without a 401(k)

Donna makes good money, but her employer doesn’t offer any retirement benefits at all (boo).

But she can still max out a Roth IRA. After her $5,500 for her Roth, she has $3,500 left. What then?

Unfortunately, there aren’t a lot of great options. I think Donna’s best bet is probably to set up a regular taxable investment account (in the same place where she has her Roth IRA) and invest there. There wouldn’t be any tax benefits (she would pay capital gains tax, for example), but it’s still better than nothing.

Here’s the graph:

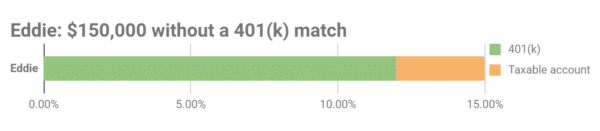

Example 5: $150,000 salary without a 401(k) match

Eddie has worked his way up the company ladder and is now bringing home a hefty salary.

You’d think he’d start with the Roth just like everyone else, right?

Unfortunately, no. There are income limitations associated with the Roth IRA. At the time of writing, it’s $133,000 a year. If you make more than that, you can’t contribute directly to a Roth.

But he can fund his 401(k). 15% of $150,000 is $22,500. The 401(k) has a maximum contribution of $18,000, so Eddie maxes out the 401(k). And as for the remaining $4,500, he would probably be best to use a taxable investment account just like Donna.

Here’s the graph:

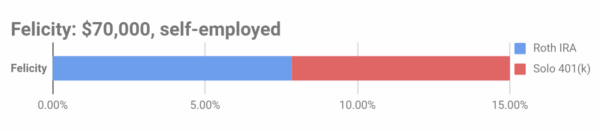

Example 6: $70,000 salary, self-employed

Felicity is a one-person shop. She owns her own business, and is the only employee.

She can fund a Roth IRA like many of the others, which takes $5,500 off of her total of $10,500. The remaining $5,000 could go into a Solo 401(k), which offers many of the advantages as an employer-sponsored 401(k).

Here’s the graph:

In conclusion

Six people, six different situations, six different routes to 15%.

By utilizing the most lucrative and tax-advantaged options first, these people are able to put themselves in as favorable a position as possible for retirement.

I hope this helps you visualize what I mean talking about contributing 15% to your retirement. Do you see yourself in any of these examples?

Was there a situation I didn’t cover? Let me know. Also, remember that this is not investment advice. Please read my Disclosure Policy.