A fortuitous experience with an insurance agent reminds me that we shouldn’t do all the financial work ourselves, that we need a financial team.

I signed up for health insurance on the Marketplace. Healthcare.gov. Obamacare. Whatever you want to call it.

For various reasons, this was the first time I had ever done this.

I wasn’t too nervous about it. I understand bureaucracy, am computer savvy, and can read technical instructions. I’m pretty solid with spreadsheets, and can do math like nobody’s business.

So I was feeling super self-assured, confident, maybe a little cocky.

When I learned that I could get a free consultation with an insurance agent, I didn’t really think I’d need it, but I signed up anyway, if nothing else to verify the decisions that I had more or less already made.

And can you anticipate how it went?

I sheepishly admit, I was totally schooled by this person, and got a deal thousands of dollars better than what I had figured out for myself.

And this reminded me, yet again, of the benefits—the necessity!—of finding people who are more smarter, more skilled, or just more experienced, and putting them to work for you.

Table of Contents

Not good with all things money-related

I’m not a tax person, and don’t claim to be. When I have a strategy call with potential clients, and they talk about needing tax advice, I say I’m not the right person to help them with that.

Getting their debt under control? You bet. Feeling more financially empowered? Definitely. Progress on their financial goals? Absolutely. But taxes? Not my department.

Similarly, I’m not an insurance guru. I understand how premiums and deductibles work, and I had a period of time where I was using a Health Savings Account (HSA), and believe me you almost need to be an insurance guru to get out of that with your wealth intact. (See also, the HSA “testing period”. Oy.)

But point being is that I generally believe I know how things work. I know what my costs are, and given a plan’s details, I can calculate more or less what my out of pocket costs are going to be.

And that’s what I had done going into my insurance consultation.

Getting schooled

But wow, what happened on that call surprised me in a way that I’m not very often surprised.

The person I spoke to told me that (for at least my situation) the plan details were not fixed, as I suspected they were, but were variable, dependent on your projected income.

Now, I thought I understood the subsidies thing. The less you earn, the more of your premiums are covered. If you make $80,000 a year, a plan may cost $700 a month, but if you make $30,000, the same plan may cost only $200 a month.

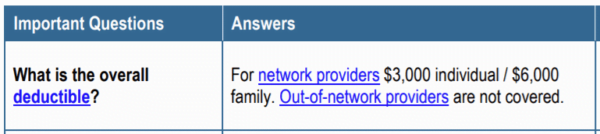

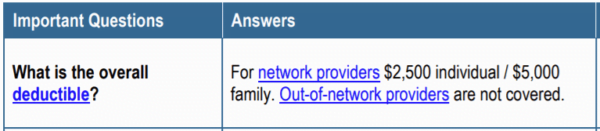

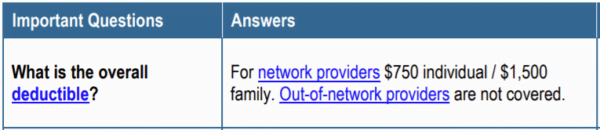

But what I had no idea of, really, zero, was that depending on your stated income, the plans’ deductible and out-of-pocket maximums would be lowered too.

And if it turned out that you underestimated your income, you’d have to pay back your subsidies, but the deductible and out-of-pocket maximums would remain the same.

This is, as far as I could tell, all above board. This isn’t a scam-the-system thing.

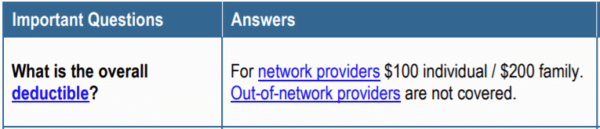

In fact, you can see online how certain plans have variable details based on the “cost sharing” aspects of them. The following (not my plan) are screenshots showing how the very same plan can have vastly different deductibles:

Find people smarter than you

Now, I have no idea if what I’m talking about is applicable to anyone else’s situation at all.

The important takeaway is that by working with someone who was much more skilled and familiar with this particular domain, I was much better served than if I had tried to do it myself.

And this is a reminder I needed, because it’s a reminder that I give other people.

Everyone has core competencies, but not everyone lists in those core competencies money management and money behavioral health. That doesn’t mean that you’re doomed to be bad with money, just that you would be better served by working with someone who excels in just those areas where you don’t.

You probably realize that the internet is no substitute for a doctor and that floss is no substitute for a dentist. So why do think that you’re perfectly capable of reaching your financial goals without any help?

I am projected to be thousands of dollars richer at the end of next year due to one phone call! Imagine what you could achieve with more sustained effort from a team.

Don’t try and do it all yourself. Get your team together.

And time-sensitive note: Open enrollment in the U.S. ends on December 15th. Get coverage. There’s no financial penalty for not getting coverage, but do it anyway. Don’t gamble with your health. Especially in this country, which will happily send you right into bankruptcy with any amount of medical bills. Do it.