Don’t stop putting money away now; instead, use dollar-cost averaging to protect yourself against uncertainty and volatility in the market.

I don’t know if you remember this, but about five years ago, while we were all in lockdown, a video was posted on YouTube.

It was a comedic video where a woman in January 2020 gets visited by herself from four months in the future, to tell her (vaguely) about what’s going to happen to her.

It’s a fascinating insight into what I call “the history of the past”, where we see a looking-back at what happened, but from a perspective that itself is in the past.

Anyway, it’s totally worth a (re)watch, but I specifically want to point out the section around the 1:10 mark:

January 2020 Julie: Wow, Okay, so what is the bad news then?

April 2020 Julie: You are going to want to pull all of your investments…Just get everything out of the stock market.

January 2020 Julie: Ohhhh, it’s a recession.

While this was supposed to be funny, and not investment advice (no more or less than this blog), it captured the zeitgeist of April 2020 quite well. The stock market was tanking, business were shutting down, and it felt like the world was ending.

And yet, taking all your money out of the stock market was possibly the worst financial move you could have made.

I bring this up because we’re now living in a new era of economic terror, except instead of a virus, it’s a person with the temperament of a toddler that is running the government, breaking things for spite.

You might think this time is different, but I don’t think so. Maybe Trump is just the COVID virus of 2025. Here’s what I mean.

Table of Contents

What happened in April 2020

This is what the stock market looked like in April 2020.

It was not looking good. A virus was circulating around the world, causing mass death and sickness, and as a response to it, the world had more or less gone into lockdown mode, causing layoffs, and reorienting people’s entire lives.

It was a scary time. So you could be forgiven for thinking that any investments you had were going to tank.

What happened after April 2020

Now let’s zoom out a bit and show a little bit more future.

Here is zoomed out to the end of 2021.

The markets recovered, and any money you had “lost” you would have regained. (Remember, you don’t lose anything until you sell.)

Let’s zoom out even further. Even with Trump’s tariff nonsense tanking the markets, you’d still have been up a fair amount.

In all cases, it would have been a terrible idea to pull all of your money out of your investments.

Dollar-cost averaging will protect your money

In general, I don’t recommend trying to time the market in either direction, whether you think it’s about to go down or up. And if you have inside information, that’s called insider trading, and that’s illegal. (Not that crime is illegal these days.)

But what happens if the market crashes? What happens if you miss out on big gains?

There’s a simple solution to all this, and that is called dollar-cost averaging.

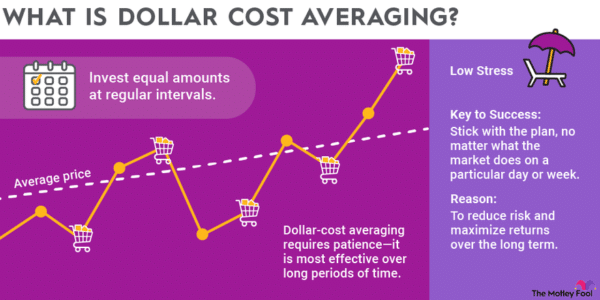

Dollar-cost averaging is the practice of putting regular amounts of money away over regular amount of time.

So instead of putting away, say $6,000 into your 401(k) once a year, making your money subject to whatever the market was doing at that very moment, you could put $500 away every month. You still get $6,000 by the end of the year, but you are a little bit insured against any major dips or jumps.

How so? When the price goes down, you get more for your money. When the price goes up, you might get less for your money, but the price has gone up, so that’s fine!

The Motley Fool has a good graphic about this that I’m going to put here:

The point here is that with dollar cost averaging, you are protected from the biggest swings of the market in both directions. It averages your returns, so you are less likely to invest money at the wrong time.

It’s basically the opposite of trying to time the market.

Don’t stop putting money away

If you are fortunate to have money to put away in savings, then I would do that. I would fully fund an emergency fund right now, or as soon as possible. (I’d pay off your debt first though before going too large in an emergency fund.)

If you have an emergency fund put away, and you have extra money to put toward investing or retirement, then good for you! That is a great place to be.

I recommend figuring out how much money you have to put away each year. Once you have that, divide it into 12 equal portions and set up an automatic transfer each month. That way, no matter what happens with the ups and downs of the market, you’ll be more protected than if you put all your money in at once.

And beyond all of this, do not pull out your money due to fear. Yes, we’re in a very scary time right now, but most of us have time to recover. It might take years, but it might not. After all, it didn’t take forever for the economy to recover from the pandemic.

Postscript

The above video suggested that Julie also invest money in Zoom, the teleconferencing company that was such a staple of the pandemic.

Well, I hope Julie didn’t listen to herself, because while the stock price was up over 400% through 2021, these days Zoom is trading at half what it was when that video came out. Clearly, Julie didn’t listen to my one hot stock tip.