There is no practical reason for most people to follow the up and down moves of the stock market, and plenty of reason to ignore all of it.

I listen to NPR a fair amount, mostly when I’m in the car, but also on solo walks around my city.

(And let me just pause right here and say that I could listen to the purring tones of Jack Speer reading the ingredients of a packet of cough drops, and find it just as soothing. Don’t believe me? Listen to this.)

Like many news stations, NPR has headlines every half hour. And while the majority of those headlines are political in nature, the last piece of news almost always looks something like this:

“On Wall Street, stock indices were mixed, with the The Dow Jones Industrial Average up sixth tenths of a percent, while the S&P 500 was down a half a percent and the Nasdaq 100 down a quarter.”

Every time you listen to the headlines, you learn about what happened with the stock market indices. Whether they went down in overnight trading, how they opened the day with the bell, whether they’re going up and down. That can be dozens of times a day, and that’s not including the non-U.S. stock market indices.

And after years of this, I just have one question.

Why do we care?

Table of Contents

Sports

Let’s start in a rather unlikely place: sports.

The news has some standard sections: politics, business, arts and culture, and of course, sports.

The sports section has details on the latest games, players, and teams. Who’s winning, who’s losing, who’s being traded, that sort of thing.

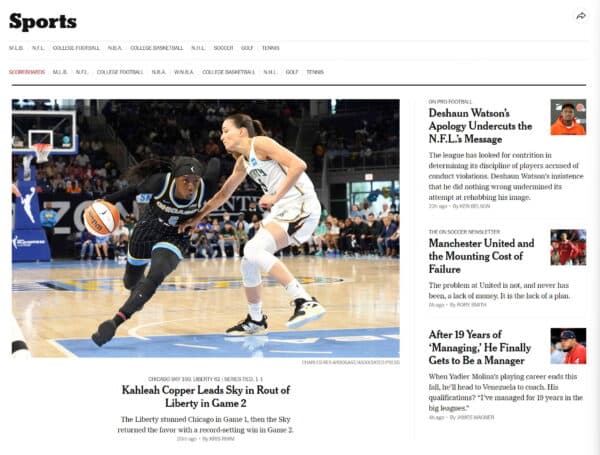

The current front page of the New York Times’ Sports section looks like this:

Notice the only link on the top bar that’s in red: SCOREBOARDS.

Why does it get so much favored placement? Because that, at heart, is what sports fanatics care about. You may not have watched the game, but you want to know the score.

(Funny aside: one time a few years back, I was at what was nominally a Super Bowl party, and we ordered pizza. When the delivery person showed up, he asked what the score was, and we had to sheepishly admit that we had no idea.)

Statistics are everything in sports. Baseball, more than any game, seems to exist just to generate statistics sometimes. Just look at the poetry of baseball statistics: Batting Average; Runs Batted In; Earned Run Average; Games Back; Runs/Hits/Errors.

People care about statistics. Sports, for many people, is their identity. “I bleed [the color of my team]” is a not uncommon phrase.

And while I’m not a huge sports fan, I understand it. There is a pleasure in watching the game of course, but there’s also a pleasure in pouring over the minutiae of the statistics.

The New York Dow Joneses

What does this have to do with the stock market? Everything and nothing.

Like sports, the financial section of the newspaper is filled with the same level of minutiae of numbers, but this time, instead of a few dozen teams, there’s hundreds and hundreds of companies, and many more mutual funds. And of course, there’s the Dow Jones Industrial Average, the index of 30 of the biggest companies in the U.S.

Every business day, the values of these publicly-traded companies, and the indexes that track them, go up and down in value in some way. Occasionally you have these crashes or rallies, but most of the time it’s small movements.

But the difference is that no one plays for the New Dow Joneses, or the S&P 500’s, or the Nas Daqs.

We may be fans of certain companies that we own stock in or are loyal to, like Apple or Google or Amazon, and in that respect, companies can be like sports teams. Just engage in or witness a Microsoft vs. Apple debate, or an iPhone vs. Android debate, and try to tell me that brands aren’t like sports.

But that’s where the similarities end.

The World Series of stocks never happens

Even if you grant that stocks can be like sports teams in the way that we feel a kinship with them, there is one big difference:

The season never ends.

There is no “World Series” of the economy. So you are tracking these numbers, up and down, up and down, to no end.

Aside from, potentially, your own. Because this is all about having enough money to invest and retire, right? No one is day trading, or picking individual stocks I hope?

Stop caring

Unless you’re on Wall Street, or work in a narrowly defined list of fields where the ups and down of the market are relevant, you do not ever need to care about the daily (or weekly, or monthly) changes in the stock market.

Knowing that the markets had an especially good or bad week will not benefit you at all, and can only harm you.

If you hear in the news that the S&P 500 took a huge dive, you may be tempted to act on this information, such as selling or moving your assets around. This can only be a bad thing. The people who win over the long term are people who ignore the news and stick to a long-term investing plan.

What about if you’re retired? Would you need to know this information to know how much money you can afford to take out?

Not if you’re withdrawing based on a safe plan, such as the 4% Rule. That rule (actually more like 4.5% or 5%) will hold in all but the most long-term dire cases, the likes of which we’ve rarely seen.

And if you’re day trading or buying individual stocks, stop.

Save the stats for sports

Following the statistics in sports is a reasonably harmless pursuit, so if you’re into that, go for it.

As for me, I’m just lucky that, as a native of Philadelphia, the primary color of the Phillies happens to be the color I already bleed.