I apply Attachment Theory to financial wellness, and show that people have their own Money Attachment Style. You can find out yours, too.

Attachment Theory is fascinating. If you’re not familiar with it, it is the study of how humans develop relationships to one another, and how your formative experiences can affect your default mode of relating.

If you are interested, there are many books on the subject, but one in particular you may want to check out is “Attached: The New Science of Adult Attachment and How It Can Help You Find—And Keep—Love“.

I’ve found that understanding Attachment Theory, along with its associated phrases (“Secure attachment”, “Anxious/Avoidant relationships”) has been very beneficial in my personal life. While these terms don’t define me or anyone else, it provides a helpful frame around which to understand interactions.

The ideas in Attachment Theory can be applied to lots of different interpersonal relationships, from siblings, to parent/child, to even coworkers.

But in doing my work with clients, I’ve determined that people have attachment styles when it comes to money too.

And just like understanding your attachment style can help you relate to your partner, knowing your money attachment style can help you in your relationship with money.

So I’ve developed a Money Attachment Style primer, using the lessons and ideas from Attachment Theory. Read on to learn more.

Table of Contents

A two-dimension model

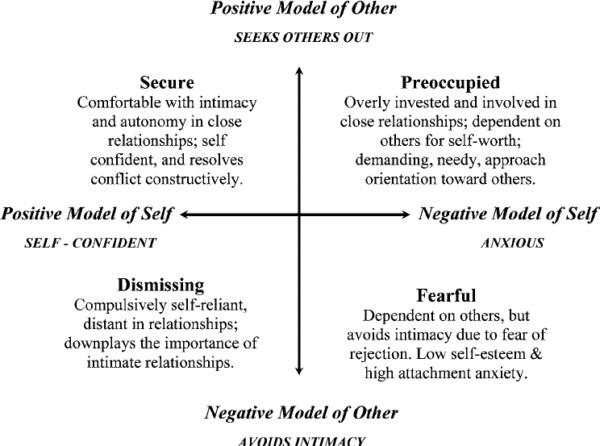

I’ve found that the two-dimensional model of attachment is the most helpful way of looking at attachment.

There are few ways of doing this out there, but the one that resonates most with my work is with the axes of “self” and “other”. On one axis, you have “Model of Self”, either positive or negative, and on the other axis, you have “Model of Other”, either positive or negative.

Based on this model, it follows very naturally to replace “Other” with “Money” to create a two-dimensional Money Attachment Style matrix. Much of the language gets adapted easily.

So let’s talk about the four Money Attachment Styles:

Secure

Positive Model of Self

Positive Model of Money

When it comes to money, you are okay with it, however it exists in your life. This is made easier by your own confidence in yourself to achieve your financial goals.

Those with a Secure Money Attachment Style know what they have, and feel comfortable with it. If they’re not in the best financial situation, they know that they can work to change it, and can feel confident that they can get to a better financial place.

When I coach clients like this, I suggest that their work is to gain greater clarity into their current financial picture and future money goals. Because their attachment to money is secure, they have very little getting in the way of their path forward, which is a great baseline for leveling up.

Anxious

Negative Model of Self

Positive Model of Money

When it comes to money, you are enamored of it, but it always feels just out of reach for someone like you. You lack the confidence in yourself to believe that reaching your financial goals is possible.

Those with an Anxious Money Attachment Style bring a lot of awareness to their money situation. They always know what’s going on, and that’s a strength.

But their hyper-awareness and stress can run them ragged. They are at risk of working hard, but not working as efficiently and effectively as they could. And the belief that they’re not skilled or good enough to have a successful relationship with money can keep them from having more of an impact.

When I coach clients like this, I encourage them to be gentle to themselves, and to learn to manage their distress tolerance. When they find negative thoughts about what they believe is possible, question those beliefs. Are they really true? Whose voice is telling them this?

Dismissive

Positive Model of Self

Negative Model of Money

When it comes to money, you look down on it. You believe that the possession of money could demean you, and you have no desire to become an “evil rich person”.

Those with a Dismissive Money Attachment Style can get by without much. They’re scrappy and down-to-earth, and those qualities have served them well.

But not overly well. Their challenge is that they are likely closed off to opportunities that would benefit them. Those opportunities are there, but they can’t be seen.

When coaching clients like this, I ask them to question their beliefs. Is it really true that having money makes them a bad/shallow/selfish person? Is it possible for someone to have lots of money and do wonderful, generous, world-changing things with it? What would that be like?

Avoidant

Negative Model of Self

Negative Model of Money

When it comes to money, you just don’t want to think about it. Your disdain for money, when combined with a lack of confidence in yourself, leads you to feel a strong aversion to any kind of money awareness at all.

Those with an Avoidant Money Attachment Style show an ability to stay standing through adverse circumstances. They’re survivors, and should feel good about that.

However, avoiding problems doesn’t make them go away. And their attachment style can make them too scared to even look at what’s really going on in their financial life.

When coaching clients like this, I give them this analogy: Remember when you were a kid and were afraid of monsters under your bed or in your closet? And when you or your parent looked under the bed or opened that door, remember how it felt to see that there were no monsters there?

The anticipation of a negative event is always worse than the reality of it. It’s never as bad as you fear it is. There are no monsters under the bed.

Take the quiz

All of this may sound great in theory, but you’re probably wondering: “What’s my Money Attachment Style?”

You’re in luck. I’ve created a quiz on determining your Money Attachment Style. It takes only a few minutes, and the lessons you learn can benefit you for years to come.

Best of all, it’s fun! Give it a try.

Understanding your Attachment style can greatly benefit your relationships. Doing the same for your Money Attachment Style can make just as much of an impact on your ability to manage, build, maintain, and direct wealth.