I’ve often said that my one big stock tip is don’t invest in stocks. There’s too much volatility, too much risk, and not enough gain.

We often say that if we had only invested in Apple in 1995, or Amazon in 1997, or Google in 2204, then we’d be rich beyond our wildest dreams.

Right, and if we had Gray’s Sports Almanac like Biff did in Back to The Future 2, we’d be filthy rich too.

But here’s the thing: we didn’t. Just like how the Next Big Thing is flying right under our radar right now, and we’re not going invest in it. By the time we hear about it, the party has likely ended.

Even still, you might think that you understand where things are heading, so you might be tempted to invest in that direction.

Don’t. (Unless you’re a professional, in which case, you probably don’t need to be reading this site.)

Here’s a cautionary tale of hubris.

Table of Contents

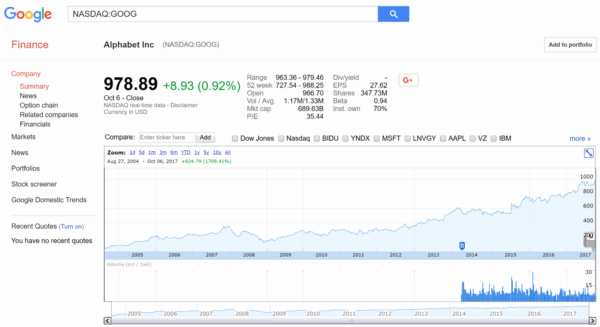

At the end of 2006, Google was flying high. It had its IPO in mid-2004, and its stock price had gone from about $50 to about $250.

And my tech-savvy friends and I thought that couldn’t last.

We looked at how almost 100% of Google’s revenue was based on ads (which it still is, come to that). And we hypothesized that this was too thin a leg to stand on, that a change in technology (say with greater prevalence in ad blocking) could cause a collapse in their revenue.

In short, we saw the stock price as totally overvalued. It was a bubble, and like all bubbles, we agreed that it would crash eventually.

“If we had money, we’d totally short Google.”

Yay for being poor

Now here’s the thing: we didn’t have any money. Out of the three people in that room, not one of us ever put in an opening order putting us into a short position.

And that’s a good thing. Because, well, look at this chart:

If we were to have put a short on Google, unless we were to sell at the nadir of 2008, we would have lost our shirts. Google’s stock price is now four times what is was when we said that it was “overvalued”.

I’ve never been so happy to have not had disposable income as when I think about that moment.

Stupid with zeros

Chris Hogan, author of the book Retire Inspired, has a saying I love. Reflecting on his years as a financial coach, he says, “I’ve seen ‘stupid’ with zeroes.”

This could have been one of those moments. Had we had lots of money to throw at that we could have lost most of it.

Now, of course it’s possible that Google is still overvalued, and that in the long run, it might collapse. But I don’t see that happening any time soon, and, as John Maynard Keynes famously said, “in the long run we are all dead“.

But let’s bring it back to the broader index of the market. What broad-based investment would have you even possibly likely to lose 75% of your investment over 10 years? It’s pretty hard to think of one, isn’t it?

Now, shorting stocks is an even worse idea for the average investor than buying individual stocks. (And I call myself an average investor.) But it still speaks to the idea that in general, you don’t know better than the market. You can do all the research you want, understand company filings, and feel like you have a pulse on the entire market space. But you don’t.

Don’t be impatient

If you’re wanting to push back, I might ask you to look inside and ask yourself why. Because I have a sense that you might be impatient. You may think you can figure things out and “beat the market”, so you can make you money sooner, without having to wait decades.

There is great danger there.

I can only make suggestions here (and not even give advice), but I don’t want to see anyone do something as equally foolish as thinking that shorting Google was a good idea.