I look at S&P SPIVA scorecards for mutual funds, which confirm what we already knew about investing: that you can’t beat the market.

Note: I’m not a financial advisor. I don’t offer financial (or legal) advice. My job is to teach you how money works and how you can get your money to work for you. Learn more.

When it comes to investing, there are really only two goals:

- Maximize returns

- Minimize loss

These exist on a spectrum. The more you seek of one, the less you get of another.

What I want to focus on today is the “maximize returns” part, which is where most of us should be focused, unless you’re actively in retirement, or have some other specific considerations.

Of course you want to make as much money from your money as possible. Why wouldn’t you?

Luckily, now there is empirical, data-based evidence on the maximum returns that you can expect to make over the long term.

And I’m hear to tell you about it.

Table of Contents

Active versus index

Let’s start with some backstory on mutual funds, which are related to my one hot stock tip.

An actively-managed mutual fund will attempt to “outperform” a particular index (such as, for example, the S&P 500). That’s how the fund can measure its progress.

This is because the index fund is blindly tracking the wider index without attempting anything savvy.

The idea is that the actively managed funds will be “smarter” and make better trades, such that the fund will make more money (even when accounting for the fund’s higher fees).

It should be a win-win, right? Everyone makes money.

The problem is, that over the long-term, this doesn’t happen.

And now there’s proof.

The scorecards and the results

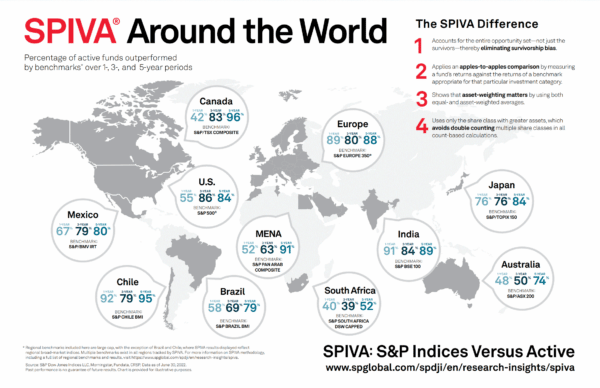

S&P Dow Jones Indices, which is a division of S&P Global (yes, that S&P), puts out scorecards each year which they call SPIVA, which stands for “S&P Indicies Versus Active”.

In these scorecards, they compare mutual fund indexes (“index funds”) with their actively-managed counterparts. They track over a range of metrics, such as different categories, sectors, and geographic regions.

They’ve done this for 20 years now. And what they’ve found, based on a recent report, yields these conclusions (bullet-points quoted below from the report):

- Most active managers underperform most of the time.

- The tendency for underperformance typically rises as the observation period lengthens.

- These conclusions are robust across geographies.

- When good performance does occur, it tends not to persist. Above-average past performance does not predict above-average future performance.

If infographics are your thing, they published one which shows performance on 1-, 3-, and 5-year timelines. Note that higher percentages mean that index funds performed better.

Look at all those 80-90% figures! And given the bullet points above, one can reasonably imagine that as the time horizon grows, the percentages will approach 100%.

Here is another takeaway from the above report:

“SPIVA can serve to remind investors that if they choose to hire active managers, the odds are against them.”

And finally, as per a New York Times article on these reports:

“Over the last five years, not a single mutual fund has beaten the market regularly…Then the analysts asked how many of those funds [which were in the top 25% percentile performance in 2018] remained in the top quarter for the four succeeding 12-month periods through June 2022.

The answer was none.

What to make of this

There is a lot of ambiguity in finance, but this is one of those situations where there isn’t ambiguity.

So the takeaway is simple: If you wish to maximize your returns over the long-term, you will almost surely make more money by investing in index funds rather than actively-managed funds.

The nice thing here is that index funds almost always have lower fees than actively-managed funds. If you’re looking through your list of funds in your 401(k) or IRA, sort by fees (“expense ratio”). The ones with the lowest fees are most likely index funds.

Here are some links to get you started:

(I list funds by certain companies, because it’s usually cheaper to purchase the companies’ index funds if your account is with that company.)

While we don’t know what the markets are going to do in the short or long term, the best thing we can do is to ride the wave of as many different companies as possible, so that you don’t need to pick winners.

Index funds do that. The S&P 500 tracks 500 companies. The Russell 3000 tracks 3,000 companies. The Nikkei Index tracks 225 companies in Japan.

If you invest in an index fund, you get the collective benefit of investing in all those companies. That way, you too don’t have to think too hard about investing, or spend too much on a financial advisor, promising that they can outperform the market.

Because now you know they can’t.