The simplest and most flexible way to build millionaire-level investment wealth is through the Roth IRA. If you can max it out, you should.

In my last post, I talked about the optimal way that you can allocate your investment money in the most effective ways possible. This can involve a combination of a 401(k), IRA, and brokerage account, depending on your income and how much money you have to invest.

But while “most effective” is fine, what I always hear is that financial wellness is just “too complicated”. When people are overwhelmed, they want something simple, something brief, something that they don’t have to think about that much.

So, if you want the simplest directive on how you can build investment wealth, for retirement or whatever else your future goals are, here it is:

Max out your Roth IRA. Every year. If you can.

You can stop reading here, but if you want some more details on what I mean, keep going.

(Note to nerds: Some of what follows is oversimplified. This post is not for you.)

Table of Contents

What makes a Roth great

A Roth IRA is a retirement account that you open and manage yourself, not through your job.

The “Roth” part means that the money that you put in doesn’t get any tax breaks when you contribute, but when you withdraw money, you don’t have to pay taxes on it.

This means that you always know exactly how much money you have in your account, without having to worry about tax rates or other confusing things.

You can withdraw your contributions at any time (though I don’t recommend it), but you’ll have pay a penalty if you try to withdraw your earnings before age 59 1/2. So contribute and then leave it alone.

(There are some other exceptions to the above rule, but it’s still best to contribute and leave it alone.)

Anyone can have a Roth IRA (almost)

Anyone can contribute to a Roth IRA, but you have to have earned income, and this yearly earned income has to be below a certain threshold (which you can find here). Most people don’t make this much money in a year, but check to make sure, and if you’re even near this income limit, sorry, no Roth for you.

A Roth can make you a millionaire

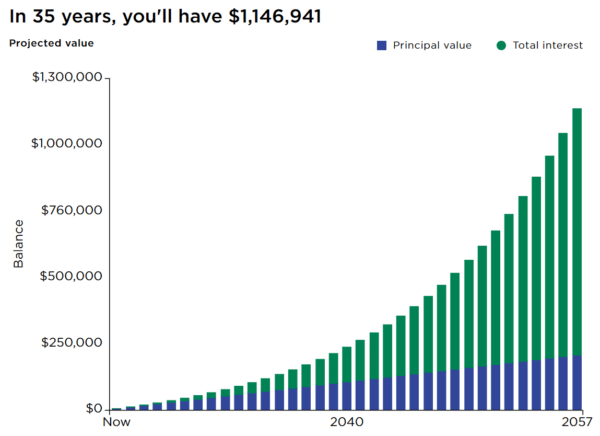

At the time of writing, you can contribute up to a maximum of $6,500 (if under 50) and $7,500 (if over 50) per year. (Check here for the updated amounts.)

This is a few hundred dollars a month. Not nothing, but this amount of money can make you a millionaire.

If you put $500 a month away in an account earning 8% interest (which is not unlikely), starting at age 30, by 65 you’ll have over a million dollars. And that’s not even contributing the maximum.

And remember that this is money that is not going to be taxed.

TL;DR: Contribute the maximum amount to a Roth IRA each year, and you can become a millionaire.

And this is assuming you don’t do anything with a 401(k) at work ever. If you do, you’ll just have even more money.

How to get started

If you don’t have a Roth IRA, they are easy to open. I created a tutorial on how to open a Roth IRA with Vanguard, though you can do the same thing with Fidelity or Charles Schwab, or basically anywhere.

And once you have the account open, and you fund the account, you need to pick investments to put the money in (pleeeeeease don’t forget this step).

I don’t offer investment advice. I will also note that a total stock market index fund is reasonably likely to return 8% over the long haul. These are products such as:

- Vanguard Total Stock Market Index Fund (VTSAX)

- Fidelity ZERO Total Market Index Fund (FZROX)

- Schwab Total Stock Market Index Fund (SWTSX)

You can also pick a Lazy Portfolio from this list. You almost certainly can’t go wrong.

Then you contribute every month, from here on out. Do it and forget it. In a few years you are going to surprise yourself with how much money you have.

Max out your Roth. Every year. Keep it simple. You can do this.

And if you’re still a little overwhelmed at this plan, please reach out to me and I can help you through the process.