Buying gold bars at Costco was a trend a year ago, but since gold’s price rise, you might be wondering if you should get in now.

We all wish we could predict the future.

We all wish we could be Biff from Back To The Future 2, who gets the book of sports results from the future, ensuring that he can bet and win on everything and become fabulously rich.

And you may remember how your techy friend suggested that you should get into something called Bitcoin back in 2011, when the price might “soar” to maybe $1 each (it’s over $100,000 now).

If only you had known.

The problem with looking back and saying “if only I’d known” is that it may lead you to make decisions now that are much worse, as you try to recreate circumstances that can’t be recreated.

For example, recently, there’s been a follow-up news story about the price of gold bars sold at Costco.

I wrote about this last year too. So I guess it’s time for me to do a follow up as well.

Table of Contents

Gold bars at Costco: A recap

To recap, in 2023, Costco started selling gold bars.

They were small, 1oz bars, more like “gold chips” than gold bars.

But their ease of acquisition—just click online and buy—cause a stir, and many millions of people went online and picked up one, or many.

As of last year, these were selling for $2,499, so this was no small buy.

I argued at the time that this was basically folly, that the price of gold has disappointed people year in year out, and that even if the price went up, the ability to sell these items would be minimal at best.

So where was I right, and where was I wrong?

The price of gold

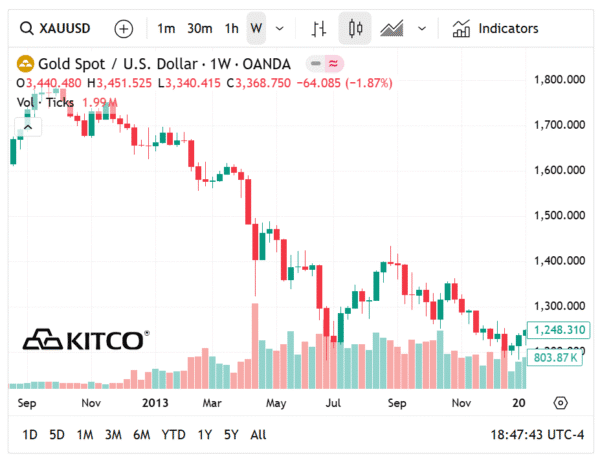

Well, here’s a chart of the price of gold over the past year. It’s been very clearly on a tear.

And this makes sense. People flock to gold in times of uncertainty, seeing it as a hedge against inflation. And there’s just a bit of uncertainty right now.

Selling gold

I found a TikTok video of someone walking into a gold shop, selling the Costco gold bar, and pocketing a cool $600.

Now, I don’t know if this video is real. I can’t imagine that a gold shop would be cool with someone coming in and sticking a video camera in the person’s face prior to making a transaction, but who knows? Every one wants to be a star.

Selling for fun and profit

Let’s run the numbers on a transaction like this today. Let’s say that you purchased a gold bar for $2,500, and now want to sell it.

The spot price of gold is around $3,350. So could you sell it for that much and make $850?

Well no, because the dealer is not going to pay you spot price. You’re going to get much lower than that.

I’m not certain, but I’ve read of getting between 1-10% below spot price. So let’s call it a 5% cut.

So you could theoretically sell your gold bar for 95% × $3,350 = $3,182. That’s still a $683 profit.

Don’t forget about capital gains

But we’re not done. When you sell a “collectible”, as these things are known to the IRS, you have to pay capital gains taxes.

Capital gains is a tax you pay when an investment earns money. It’s what makes products like Roth IRAs and 401(k)s so great, in that those investment vehicles are sheltered from capital gains taxes, allowing your money to grow more quickly.

The amount of capital gains tax you pay on a collectible depends on how long you’ve held it:

- Less than one year: Your standard income rate

- More than one year: Your standard income rate but capped at 28%.

So let’s say that you’re in the 24% tax bracket, so that’s what you’d pay.

24% × $683 = $164, so your profit was actually $519.

Now, that’s a solid 20% gain on your returns, which is not bad at all.

The wrong lesson to take from this

So, you could easily take the view from this that one should drop everything, buy a bunch of gold bars, and in a year, go sell them for a 20% profit.

And that is exactly the wrong lesson to take from this example.

We like to think that investments always go up, but that isn’t the case. And gold has been disappointing buyers for decades now.

Here’s a year in which gold lost almost a third of its value.

So is gold going to continue its inexorable rise at the same pace? Don’t bet on it.

Also, my back of the napkin, non-scientific view on investment trends is that by the time a trend is mentioned in an article on a site like CNBC’s Make It, it’s probably too late to get in on it.

The right lesson to take from this

Everyone wants to find that one secret trick that will help make them rich faster than everyone else.

That trick doesn’t exist, outside of luck. Sorry. You can become wealthy, but not through tricks like this.

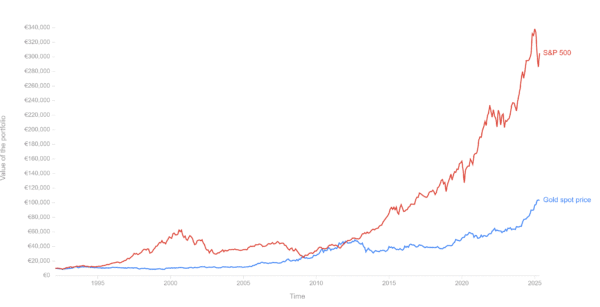

I know I’m a boring investor, but just look at this chart:

This is a chart comparing the returns of the S&P 500 (a proxy for the wider stock market) and the gold price. What do you notice?

The S&P 500 has wiped the floor with the gold price consistently over the long term.

Yes, this year may have been an aberration. But that’s just the point; it’s an aberration.

So unless you want to track the markets religiously and buy and sell when you think it’s most advantageous, you’d still be better off steering clear of gold bars from Costco or any other meme investment. Instead, take the money you have and put it in a simple index fund, like one that tracks the S&P 500.

It’s not as exciting, but in the long run, you’ll have more money. Actually, that is pretty exciting.

So the question is: what will gold bars do next year? And are you invested in Costco gold bars? Why or why not?