The inflation-adjusted Series I Bonds seems like a good place to park your money, but is that actually the case?

Nothing here is financial advice. Please see my Disclosure Policy.

I recently got this question sent to me from one of my readers:

I keep reading about US Treasury I Bonds and the very high interest rate they are offering at the moment. Is this a good place to plunk some money for the next 5-30 years, or am I missing something? Should I buy them?

Sincerely,

Not Entirely Sure Trusting Endtimes Government’s Gonnabe Smart

Well, NESTEGGS, here’s way more than you probably wanted to know about this.

Table of Contents

What are I Bonds?

I Bonds, or more formally, Series I Savings Bonds, are interest-bearing products put out by the U.S. government that are partially tied to the inflation rate of the wider economy.

“A series I bond is a non-marketable, interest-bearing U.S. government savings bond that earns a combined fixed interest rate and variable inflation rate (adjusted semiannually). Series I bonds are meant to give investors a return plus protection on their purchasing power.”

So this bond is designed to protect against inflation.

And I bet I have your attention now, because inflation is on everyone’s minds.

How bonds usually measure up

Traditionally, bonds are the lower performing option when compared to stocks (and most mutual funds), but they are seen as safer, because you’re almost never going to lose principal.

However, that pesky risk/reward equation reminds us that if you don’t have a risk, you won’t earn a big reward. You can bend that rule here and there, but you can’t break it.

So most bonds of any sort earn a low interest rate, from less than 1% to a few percent. That isn’t all that interesting if you want serious capital appreciation, which I’m assuming you do.

I Bonds are different (now)

But I Bonds, because they are designed to protect against inflation, work a little differently. And, as NESTEGGS points out, they are definitely having a moment now. For example, this recent report from NPR.

Why? Currently, Series I bonds have a composite interest rate of 9.62%.

To which I say: 🤯

But because that number is revised every six months, it could go up, and it could go down.

Past returns

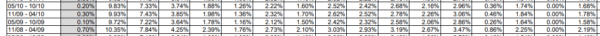

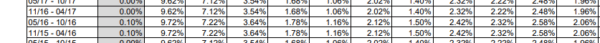

If you want to dig way deeper than you probably want to, check out this chart, which has historical values for Series I bond rates.

This chart tells us a number of things. One of which is that you probably need glasses, but the other is that we should have bought I Bonds in 1999, because then we’d be earning 13% today.

If you’re curious, here’s how the composite rate is calculated:

If you had bought an I Bond in May of 1999, where there was a fixed rate of 3.30% and a variable rate of 4.81%, the composite rate would be 13.08% as of the time of writing.

But the fixed rate is currently 0%, and has been around that for years now. This is a drag, because the fixed rate portion of the composite rate is fixed for the life of the bond, regardless of what happens with inflation. You’re most likely going to be at the mercy of the variable rate, which will rise and fall with inflation.

And that’s the big hitch here: we don’t know what’s going to happen with inflation. It’s been very low for most of our lives, but has been on a tear recently, as we all know.

More past performance

Back on that eye-straining chart above, let’s look at another example in time.

Look at the rows around the year 2009. If you read across, aside from the most recent times (on the left) the variable interest rates have been between 1-3% for almost the whole time. This translates into a return of around 3-6%.

Meanwhile, investing in an S&P 500 index fund equivalent would net you 11% per year, even adjusted for inflation (at least according to this calculator).

Now 2009 might be a bad example, so how about 2016, when the market was booming? Aside from the last year or so, the Series I bonds also yielded around 3% (so roughly a 6% return).

That same time, the S&P 500 yielded around 9%.

Now, granted, you could buy some Series I bonds and then cash them out if they underperformed. The worst penalty I could find was that you would have to forfeit three month’s worth of interest. (But if you were cashing them out, that probably wouldn’t amount to much anyway.)

That said, if you want a set-and-forget solution, this isn’t that.

TL;DR

If you believe that inflation is going to be high for the long term (5-10 years or more), then Series I bonds are definitely a great way to go.

But if not, not so much.

I personally don’t think that inflation is going to stay high, at least not on any scale that would make this a better scheme than long-term, boring, ho-hum index funds. But that’s just, like, my opinion, man.

Of course, with index funds, you have to pay capital gains tax when you withdraw, unless it’s part of a tax-advantaged plan like a 401(k). But even then, this seems like a draw to me.

That said, if you wish to put in a small portion of your portfolio (you can only buy up to $10,000 each year, so it wouldn’t be that much anyway) as a little bit of a hedge against inflation, it could be fun to see who wins the race.

If you’ve got a money question for me, shoot me a message. I’ll be happy to tackle it in a future post.

Again, nothing here in this post should be considered financial advice. Please see my Disclosure Policy.