So, purchasing something in a different currency when traveling out of the country isn’t as simple as it sounds. If you’re not careful, you can get charged extra, depending on what entity does the conversion.

This is also starting to happen at ATMs as well. Which means that you have even more opportunities to make decisions that could cost you.

I was recently in Canada, and while I was there, I hit up an ATM. I didn’t need much cash, only 20 CAD (CAnadian Dollars), enough to handle the tiny purchases where a card just wouldn’t make sense.

At the fee display screen, I saw that I would be charged 3 CAD for using the ATM. That’s no more annoying than using an unknown ATM in the US, so I was prepared to let it go. (My credit union refunds ATM transaction fees too.)

But then I was given an option to be charged in Canadian dollars or U.S. dollars.

Now, given all that I’ve said, I chose to be charged in the local currency, the 23 CAD route.

But what about my other option? It was to be charged in 18.26 USD. What was the difference?

A fair amount, actually.

Let’s do the conversion ourselves

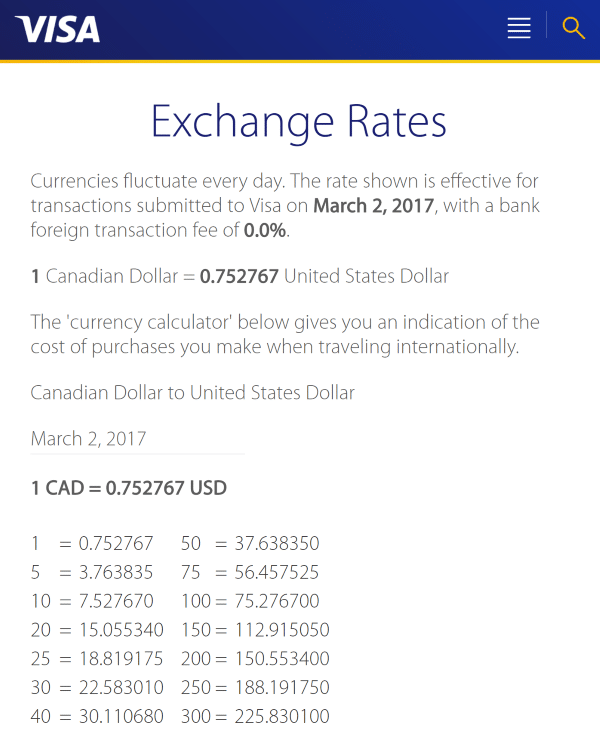

First, let’s see what the VISA currency conversion rate is for that day. It’s pretty easy to do actually. Here is the direct link.

So 1 CAD = 0.752767 USD, and therefore, 1 USD = 1.328432 CAD. Being nice, I’ll round down to 1.32 CAD per USD.

And look above. Notice what rate I was going to be charged by the ATM if I did the conversion there? 1.2598 CAD! That’s almost a 5% difference!

Let’s see the difference

Now, on the other hand, my credit union charges me a 1% foreign transaction fee, which is something I wouldn’t have paid in that case, but still, where’s all that extra money going? It’s not to me.

So here is what I got charged by using the local currency:

$17.31 (23 CAD)

$0.17 (1% FTF)

= $17.48

Compare that to the charge to use US converted currency:

$18.26

This means that I saved 4.4% on my transaction just by using local currency. And I would have saved money on this transaction even if I would have used a card with a 3% foreign transaction fee.

Now, in this case we’re only talking about $0.78 here. But over time, these sums add up. Make sure you push the right button. Or in the above case, the left button.