Congress has just passed the One Big Beautiful Bill Act. Is it as bad for you as people are saying?

Money is political. How you spend your money is a reflection of your values, and how a country spends its money is a reflection of its values.

And, so, here we are again with another giant spending bill. It feels like just yesterday that we were here before.

Congress has just passed the One Big Beautiful Bill Act. It’s a giant spending bill, and it’s going to be very consequential for years, to say the least.

We can all agree on that, but I think that’s all we agree upon.

I’ve been reading a lot about this bill as it’s limped its way over the finish line. And I’ve heard everything from “this is exactly what will help jumpstart the economy again” to “this is the most cruel, incompetent bill ever to pass Congress”.

Where is the truth? I don’t care about histrionics. I want to know what the truth is.

So let’s dig in and see what we can learn, and how it affects you.

Table of Contents

Read the bill

If you want to know what’s in the bill, you have to read it.

Well, here it is, all 870 pages of it.

Congressional Budget Office

Now, I love you all, but I’m not going to read 870 pages of dense legalese. So I’m starting with the Congressional Budget Office.

The Congressional Budget Office is a non-partisan federal agency that provides Congress with objective, impartial analysis related to the federal budget and the economy.

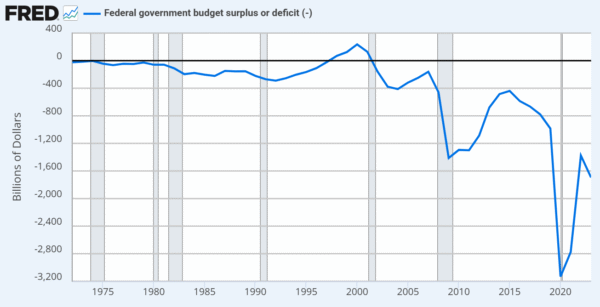

And it says that passage of the bill would add $2.4-$4.5 trillion to the deficit over the 2025-2034 period, depending on whether some temporary tax cuts are made permanent.

That does seem like an awful lot, but I’m actually not much of a deficit hawk to be honest. Unlike personal finances (and state governments), the federal government doesn’t have to balance its budget, and through most of recent history we haven’t. And we’ve been doing rather okay with that, being the world’s reserve currency at all.

But if we’re not going to balance our budget, what is the $2-4 trillion deficit going to do for us?

Average the sources

Because most of us aren’t going to read an 870 page bill, we need to rely on other sources to interpret the data for us.

And this necessarily means that these intermediate sources’ bias will be included in the analysis.

So what do we do?

Personally, my plan in these situations is to “average the sources”. Meaning, take a sample of right-, left-, and center-leaning sources, see what they all say, and then sum it up from there.

So that’s what we’re going to do. Starting with:

New York Times (bullet points)

The New York Times looked at what’s in the bill. Here are some hand-picked bullet points from the list:

- Permanently extend lower tax rates from 2017

- Changes to the state and local tax (SALT) deduction, from $10,000 to $40,000

- No tax on overtime, tips, or car loan interest

- Allow states to require more paperwork and more frequent eligibility checks for people in Medicaid

- New work requirements for Medicaid eligibility

- Limit SNAP (food stamp) benefits to citizens or lawful permanent residents, with some exceptions

- New SNAP work requirements

- Phase down tax credits for low-emissions electricity sources like wind, solar, nuclear and geothermal power.

- Terminate a number of clean energy credits

- Limit student loan income-driven repayment options

- Expand capacity to detain immigrants taken into custody

- Fund border barrier system construction and related activities

New York Times (analysis)

Okay, so that was a giant list, and I only took a few bullet points from over a hundred of them.

But this isn’t really what we’re looking for. We’re looking for analysis. So let’s get some analysis in the works:

“[The measure] would provide the upper classes…with tax cuts worth approximately $4.45 trillion over 10 years. The measure would offset the cost with the largest reductions in safety net programs in recent decades, if not all time, for those on the lower tiers of the income distribution.”

“[T]he legislation’s permanent tax cuts combined with spending increases on defense and border security and large cuts to Medicaid and other social spending would add more than $3 trillion to the national debt over the next 10 years, with more red ink in the years and decades after.”

“[The bill] is sure to put at risk billions of dollars of investments in renewable energy, mostly in Republican states, and potentially kill the jobs of tens of thousands of U.S. workers…So, in one fell swoop, this bill will make your home hotter, your air-conditioning bill higher, your clean energy job scarcer, America’s auto industry weaker and China happier.”

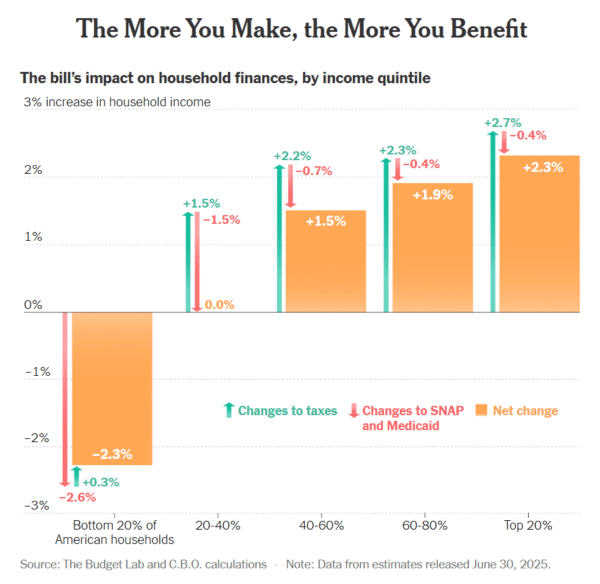

“The legislation will be far more beneficial for the wealthiest, at the expense of those farther down the economic ladder…[T]he fifth of Americans with the least wealth will suffer an estimated loss of $560, largely because of the effect of the cuts to Medicaid and food stamps.”

Fox News

Let’s contrast this with a right-leaning news source. This is what Fox News says is in the bill.

“This law protects the middle-class tax cuts that have fueled economic growth, expanded the child tax credit that so many families rely on, and ends taxes on tips and overtime, giving hourly workers the raise Washington never let them keep before.”

“[The bill] provides lower tax rates for all. Permanent, immediate expensing of business investment. Tax simplification. America competing in the world economy with lower taxes, not lower wages…the doubling of the child tax credit and standard deduction, the lower, across-the-board personal income tax rates for all Americans, and the powerful pro-growth immediate business expensing provisions.”

“[The bill is] so big, so sprawling, that it’s become a Rorschach test for what you believe. If you oppose Donald Trump, you see it as a symbol of everything that’s broken about Washington. If you support him, you probably see it as big and, well, beautiful. Republicans are calling it a historic win. Democrats warn it’s a disaster for healthcare and the social safety net.”

Other views on the left and right

Let’s go with some more takes from various left and right viewpoints:

By stripping away health care and food assistance from working-class people and undermining production of American-made energy, the OBBBA will increase the cost of living and lower after-tax income for the bottom 40 percent of earners while giving the top 20 percent of earners a $6,000 per year average tax cut. Several lesser-known, yet no less extreme, changes to the bill will further increase costs, embolden the Trump administration’s overreach, and waste taxpayer dollars.”

CNBC:

“The final bill makes permanent Trump’s 2017 tax cuts while adding new relief, including a senior ‘bonus’ to offset Social Security taxes and a bigger state and local tax deduction. The plan also has tax breaks for tip income, overtime pay and auto loans, among other provisions. The GOP’s marquee legislation will also enact deep spending cuts to social safety net programs such as Medicaid and food stamp benefits, end tax credits tied to clean energy and overhaul federal student loans.”

“Changes to taxes and Medicaid and SNAP spending proposed by the Senate budget reconciliation bill would result in a decline of 2.9 percent (about $700) in income for the bottom quintile, but an increase of 1.9 percent (about $30,000) for the top 1 percent…Policymakers have said that they will partly pay for the spending in this legislative package through tariffs.”

“The massive 2025 budget bill, which Congress passed on July 3, would slash safety net programs for older adults, people with disabilities, and their family caregivers, though many of those cuts may not take effect for years. At the same time, the bill would lower taxes for some older adults. The measure would reduce Medicaid spending by nearly $1 trillion over the next decade, largely by cutting the federal payments for the program and imposing a work requirement on many recipients, perhaps including some family caregivers.”

Summing up

After reading way too much about this bill, it certainly seems to me that Republicans have given wealthy Americans tax cuts, and decided to pay for it by cutting our existing social safety net. This will likely make life more difficult and more expensive for those who require a greater level of care (such as the poor, the elderly, and the sick).

If I can tie some rationale to all this, it’s purpose appears to be to spark economic growth. Whether people honestly believe that lower taxes will spark economic growth is another question. Tax cuts have a many-decade history of not leading to economic growth, but sometimes beliefs don’t have facts to back them up. Even in recent history, the 2017 tax bill benefited business owners and executives more than average workers. Did it spark growth?

Now, I’ll be fine under this bill. I’ll almost certainly benefit. Yay for me. I don’t need it.

Interestingly, some of the people who are most going to be negatively affected by this bill appear to be those with lower-incomes who overwhelmingly voted for this administration. Do they know? Do they care? Or is it really just about owning the libs?

When rural hospitals start to close, as is expected, will those people see it as a result of the people they voted for? Unfortunately, I doubt it. Right-wing news will probably find a way to blame it on Biden.

What can you do next?

I kind of want to give the last word to Ramit Sethi, who wrote this in his recent newsletter:

“What can you do next? Nothing. This will become law. The chance to make a change was in the last election. Now it’s too late.”

And this is true. There is nothing that can be done now. We have to deal with the consequences of whatever this thing is going to be.

You want to do something? Vote in the next election. And the one after that. And the one after that.

This time around, a majority of voting America voted for the Leopards Eating People’s Face Party, it seems. And they really didn’t think that it would be their face getting eaten.

But it was all worth it to lower the price of eggs, wasn’t it?