Buy Now Pay Later (BNPL) firms like Affirm, Klarna, and Afterpay have revived an age-old idea of helping people buy things they can’t afford.

I’ve spent a good portion of my adult working life in companies aligned with, if not located in, Silicon Valley. In fact, the world of technology startups has been one of the most exciting fields I’ve ever worked in (that doesn’t involve helping people feel confident and empowered with money, of course).

But that said, it’s hard to look at the big, popular ideas coming out of Silicon Valley these days and think that they are anything but predatory and vulture-like, seeking to extract money from an existing system and put it in the hands of venture capitalists at the expense of literally everyone else.

We saw this with Uber: “Let’s take an existing system, artificially depress prices, put cab drivers out of business, hemorrhage billions of dollars in the process, and make VCs rich. Then, once people are locked into our platform, we jack up the prices and walk away to find the next system to destroy.”

DoorDash/GrubHub and the like are the same thing. “Let’s insert ourselves into a barely profitable ecosystem, artificially depress prices, and force companies to cut prices to the bone, while VCs make billions.”

And when Silicon Valley isn’t destroying existing businesses, they are recreating them from scratch.

And we’re seeing this with the proliferation of “Buy Now Pay Later” (BNPL) services.

Congratulations, Silicon Valley, you just reinvented the credit card, layaway, and payday lenders all at once.

Let’s take a look and see how it works.

Table of Contents

What is Buy Now Pay Later?

Buy Now Pay Later (BNPL) is exactly what its name implies: You make a commitment to purchase a product, you get the product now, and you pay later, usually in installments.

If this sound very familiar, it should. This type of method of purchase has been around forever. The concept of “layaway” is very similar, and that started in the 1930s. So we’re not dealing with anything super new here.

What we are dealing with is a slew of new companies pitching this as a new thing to a vulnerable population, and claiming that it’s a way to help people achieve financial freedom.

Buy Now Pay Later is everywhere

I’m not on social media that much these days, but my partner is on there a lot for her work, and she asked if I had seen ads for BNPL, because apparently, this is all over Instagram.

I hadn’t, but I recently went to order some pants, and there at the checkout screen was an offer to pay in four installments.

I also received an email regarding my Stripe account, and they wrote to tell me that—congratulations!—I was approved to accept Affirm, Klarna, and Afterpay on my own sales. (They clearly don’t know what I’m selling.)

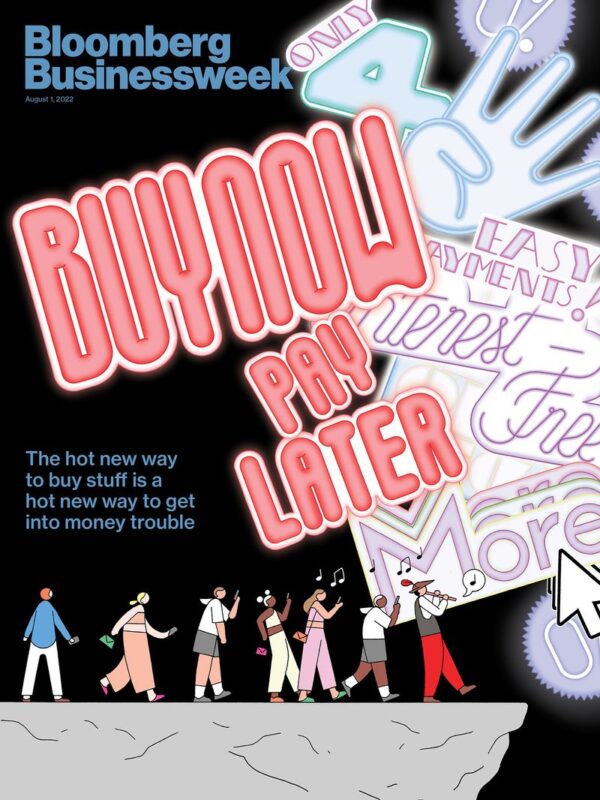

Add to that how Bloomberg Businessweek has BNPL on its cover right now, and you know this stuff is trending.

The new players

The biggest new player in the space appears to be Affirm, though the names Klarna and Afterpay are seen just as often.

So let’s look at one of them, Affirm, to see just how this sort of thing work.

Affirm’s sales pitch says “pay at your own pace” and mentions that it has no hidden fees and no late fees.

Sounds fine-ish so far, but what are the details?

How it works

If your checkout cart supports Affirm, you have two options:

- Pay in 4: The total cost of your purchase is divided into 4. You pay 25% of the cost of the purchase now, and then each subsequent 25% portion every two weeks. This is free to the buyer; there are no interest or fees if you pay this way.

- Monthly payments: Exactly what it sounds like, except that here there is interest charged. You have an option of how many months you want to pay it off in.

The site gives a hypothetical example of a $500 purchase and shows a 15% APR. At one place on the same page it states that the APR could be as high as 30%, and at another as high as 36%, so who knows exactly what the highest APR possible is.

What happens if you’re late on payments?

Affirm indeed doesn’t charge fees, so if you’re late, you’re late. They may prevent you from using the site in the future though.

There’s a difference depending on whether you use Pay In 4 or Monthly Payments though, because the latter is an actual loan, and therefore it can affect your credit score, just like any missed payment.

Who is this for?

If you ask the company, they say it’s for people who don’t like credit cards:

We started Affirm because credit cards aren’t working. They lure us in with perks, but end up costing a lot: The average U.S. household has $6,000 in credit card debt. With Affirm, you’ll never owe more than you agree to up front. Instead, you’ll always get a flexible, transparent, and convenient way to pay over time.

I’ve also read that some of these firms were/are targeting the “underbanked”, those who had bad credit and weren’t eligible for credit cards or traditional loans. If this is the case, then that rhymes pretty heavily with the subprime mortgage crisis, doesn’t it? (“When other banks won’t give you a mortgage, we will!”)

But regardless of who it’s aimed at, the primary user of this service is, unsurprisingly, Millennials and Gen Z folks, the people scrolling through Instagram and TikTok.

Also, people who want to buy guns.

Why Buy Now Pay Later is awful

I’ve got an idea. Let’s combine the high interest rates of payday loans, the behavioral economics of credit cards, the mindset of a subprime mortgage lender, the malevolence of online platforms such as Facebook and Instagram, and the billions of venture capital funding from Silicon Valley.

But don’t worry, this is good for the consumer. Trust me.

Buy Now Pay Later exploits the quiet desperation of financially tenuous people, makes them think that they are obtaining a discount, while at the same time, “getting one over” on those evil credit card companies.

Meanwhile, with every purchase that someone Pays In 4, or worse, sets up monthly payments on, that purchase extends to the next month, where more Pay In 4 purchases can likely happen. When those purchases are normalized, the result is a payday-lender-like spiral, where you end up paying for purchases you made months ago, leaving you with less money to spend on what you need this month, which will make Paying In 4 be almost mandatory for things going forward.

The ghost of Juul

This whole thing makes me think of Juul, the e-cigarette company, started by two grad students at Stanford who claimed they were on a mission to help people quit smoking.

Yes, you heard that right: the thing that allows people to more easily suck in N times the amount of nicotine as in regular cigarettes has in its founding an attempt to get people to stop smoking.

BNPL is the same creature: creating an easy way to get people into debt products and then claiming that this is the way to financial freedom.

That’s abhorrent.

These people, to use a favored term of culture critic Ed Zitron, are ghouls, and no amount of dressing this up with “financial freedom” and “serving the underbanked” or “we hate credit cards too” can change that.

If they really wanted to help people achieve financial freedom, they would go out of business immediately, and take their runway money and use it to lobby lawmakers to force minimum wage increases. Or simply give their money to everyone making less than a livable wage.

What to do instead

Luckily, no one needs to use any of these companies.

If you can’t afford something now, but could afford it over two months or so, here’s what you do:

- Divide the purchase price into four.

- Every two weeks, put that amount into a savings account or a desk drawer.

- In six weeks (not eight; watch out for the fencepost error), purchase the thing using your own money.

Of course, you’ll have to wait a few weeks to get the thing you want, and that requires restraint and patience, which is super boring of course. But on the flip side, you won’t have a debt spiral on your hands.

I call this plan Pay Now, Buy Later. Now where’s my VC funding?