A partnership between Klarna, a Buy Now, Pay Later (BNPL) company, and DoorDash, a delivery service, is so late-stage capitalism.

Buy Now, Pay Later (BNPL) services are vile. Let’s get this out of the way. While not as usurious as payday lenders, they feel like they operate somewhere in the same area.

Is that too harsh? How are these services different from credit cards?

Because even more than credit cards, BNPL services are designed to make you think that you can afford things you can’t.

You could argue that credit cards give you airline miles or cash back, or even buyer protections. But BNPL firms tell you that the $200 thing you want to buy is just four monthly installments of $50. You have $50, you don’t have $200, and you buy it anyway.

That may seem fine, but if you do that once a month for four months, you’re paying $200 a month, exactly what you couldn’t afford.

All this is bad enough with medium-ticket items such as clothes or electronics. But it seems like the name of the game in late-stage capitalism is “first as tragedy, second as farce” (apologies to both Karl Marx and Slavoj Žižek).

Because Buy Now, Pay Later is now coming for your burritos too.

Table of Contents

Buy Now, Pay Later for burritos

Klarna is one of the big names in Buy Now, Pay Later. They’re big enough that they’ve recently filed for an IPO on the New York Stock Exchange.

Clearly, that means that they’re doing well. In fact, according to their S-1 filing, they had $105 billion worth of transactions in 2024.

(Though maybe they’re not doing so well, too. You never know.)

Since companies need to grow at all costs, they’re not content with clothes and electronics. And they just announced that they are partnering with DoorDash, the delivery service.

The headlines wrote themselves. My personal favorite is “Burrito now, pay later” from Business Insider.

What’s wrong with this

DoorDash offers almost irresistible convenience. You click a few buttons, and that burrito gets delivered to your door, and all for the cost of a roughly 200% markup, give or take.

I’m not going to knock DoorDash too much. There are times when it makes sense to order DoorDash, and they have deals that sometimes make it almost the same price as going through the actual restaurant.

But I’ve seen how easy it is for people to go overboard with DoorDash, and that can make your monthly food costs shockingly expensive.

So you could argue that DoorDash is a problem for those with impulse control issues.

Then BNPL enters the chat, allowing you to impulse shop to your heart’s content, all while spreading out the costs over four equal monthly payments.

A guardrail, for now

Okay, so you can’t actually order a burrito on DoorDash, not unless it’s a super-expensive one. Klarna states that there’s a minimum $35 charge to use its services on DoorDash.

But why stop at $35? It seems to me that if there’s nothing wrong with your services, then there shouldn’t be any reason not to use them for everything, right?

Maybe we’re saved by a guardrail here not for any reason other than the grim reality of servicing these debts: it doesn’t pay for Klarna to bother.

That said, $35 is around the median price of a DoorDash order these days, and frankly, $35 isn’t what it used to be.

A reminder

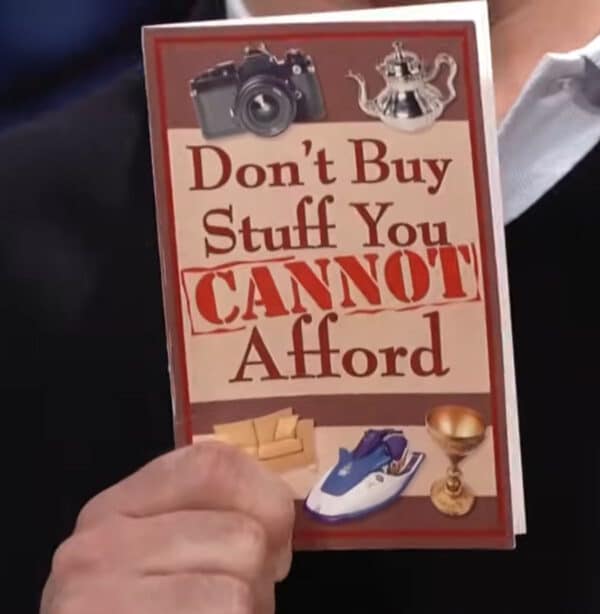

In general, if you don’t have the money pay for something, then wait until you do.

If you want something that’s $200, and you only have $50 a month to spend on it, then wait three months, saving $50 each month, and then buy it outright. Three months isn’t that long, and this way, you don’t need to worry about debt or buying something you can’t afford.

And if you can’t save up for something in three months, then you wouldn’t be able to afford using a BNPL service anyway.

So when factoring in for risk (of late fees and payments getting out of hand) there is no legitimate use for BNPL services.

I tried to order a burrito

I went on to DoorDash and pulled up my local Chipotle. I threw a burrito in the cart and looked at my options. (Actually, I threw four of them in to make sure I was over the $35 mark.)

I was disappointed to see that Klarna was not available when I went to check out. (Evidently, the service hasn’t launched yet.)

Oh well, I can still use my HSA card.

Wait, what?