I review the book “Everyday Millionaires” by Chris Hogan and its fundamental question: can anyone truly become a millionaire?

Hello there! Stop spending so much time searching online for answers to your money questions. Work with me and I’ll get you on the path to financial success. Find out more.

The word “millionaire” has a lot of emotional meaning. It carries the weight of financial success, even if it doesn’t necessarily mean that so much anymore.

Update (December 14, 2019): The Dave Ramsey team have since released the data from the millionaires interviewed for this book. I was originally critical of the book for not showing its data, and I applaud the team for their transparency.

Update (February 17, 2020): I reviewed The National Study of Millionaires, the study that is the primary data source for this book.

Don’t get me wrong, if you’re a millionaire (defined as someone with t least $1 million in financial net worth) you’re probably doing okay. But not necessarily. And many people are going to need at least that much, if not more, to truly achieve financial freedom.

But because “millionaire” has so much emotional gravity associated it, and people still want to get to that achievement, an understandable question goes beyond “how can I become a millionaire?” to the more refined and contemplative “what are millionaires like?“

This impulse to know other people’s success is why we read sports biographies. But here, there’s an element of possibility. No one believes that they will become Tiger Woods, but people do believe that they can become wealthy.

Well, some people believe it. And for everyone else, there’s a book whose avowed aim is to persuade you that you—anyone, really—can become a millionaire.

That book is “Everyday Millionaires” by Chris Hogan.

Let’s talk about it.

Table of Contents

The book

The full title of the book is Everyday Millionaires: How Ordinary People Built Extraordinary Wealth—and How You Can Too.

So clearly we know at the onset that this is going to be a persuasion piece. The goal is going to be to convince you that you can become a millionaire.

(I reviewed Chris Hogan’s previous book, Retire Inspired, as well.)

I was initially attracted to this book because I agree with the sentiment. I believe that anyone can become a millionaire, given the right choices made day after day over a long period of time. You won’t become a millionaire tomorrow, but you might in a decade or three. It’s all up to the decisions you make now. And I believe that there is less luck involved than many think.

But the real hook for me was the research. In preparing this book Chris Hogan, part of the Dave Ramsey team, interviewed 10,000 millionaires, making this the largest survey of millionaires ever.

The Millionaire Next Door sequel

The obvious parallel for this book is Thomas Stanley and William Danko’s The Millionaire Next Door, a book published in 1996 that was the result of careers spent working with millionaires.

I found that book very enlightening, mainly in its main point that people can be loosely categorized into two camps:

- UAWs: Under Accumulators of Wealth

- PAWs: Prodigious Accumulators of Wealth

To oversimplify, UAWs tend to prioritize looking rich (buying expensive cars and houses, outward displays of wealth), while PAWs tend to ignore all of that in favor of actually building wealth. The tension between looking rich and being rich was one that always stayed with me.

But 1996 was a while ago. It’s high time to update the narrative and see how millionaires are living today.

Where’s the research?

I’ll admit it: I was looking for data. Charts, tables, research methodology. I wanted to access as much of the actual data for myself, and not just the summaries.

Partly the reason for this is that I’m a nerd, but also it’s because I’m a skeptic. When someone wants to convince me of something, I want to shoot as many holes in the argument as I can. If afterward, the argument still holds, I’m convinced.

And since there’s a persuasive angle to the book, one could argue that it’s effectively a commercial for the Dave Ramsey Plan (which I’ve talked about here and here). Which is fine, but it means that statistics and conclusions can be cherry picked to fit the desired outcome. And so there’s a clear potential conflict of interest.

Unfortunately, I was to be denied on the data front. There was not a single table in the book. There was lots of statistics quoted in the form of percentages, but that was all.

For example, here’s one of many tables of data from The Millionaire Next Door that I found from skimming through the book online.

By contrast, the equivalent information in Everyday Millionaires consisted of lines like: “73% of millionaires have never carried a credit card balance in their lives.” That’s all you get.

Who are these people?

The Dave Ramsey team surveyed 10,000 millionaires. By contrast, according to the book, there are 11 million millionaires in the U.S. today.

Therefore the survey sampled 0.09% of millionaires in the country.

Now, you can’t expect them to interview everyone, but it does beg the question: who are the people who were counted?

Presumably, this class of people includes people who are aware of Dave Ramsey. And it’s not a stretch to say that there is cultural demographic that is the typical fan of Dave. For example, I’ve been listening to Dave Ramsey for almost a decade now, and I have yet to hear a same-sex couple do a debt-free scream. Whereas, I have heard countless young, devout, Christian couples in their early thirties with four kids talk about how their faith in Jesus helped them pay off their house.

I’m just saying, I’m not yet convinced that those surveyed are the “typical millionaire”. I would go so far as to say those surveyed are the “typical millionaire…who listens to Dave Ramsey.”

Is that the same thing?

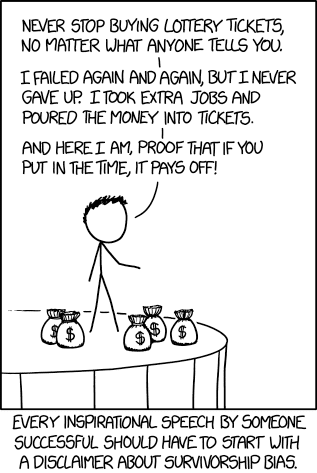

Survivorship bias

The research done was (to my knowledge) online and pseudo-anonymously. Participants were allowed to self-disclose as they wished, and it’s unclear if any verification was undertaken.

Immediately this calls the whole thing into question. This is because of survivorship bias.

Here’s XKCD to explain:

No one would ever look at a lottery winner and say, “because they did it, I can do it too.” (Well, actually, they might, butthey shouldn’t.)

What the survey does then is ask successful people to self-identify what their habits are. The book then extrapolates from this that if you do these things then you too will become a millionaire.

This is doubly wrong. First, people are notoriously bad at self-identifying. Take this example:

Nearly all—99% of millionaires—say their friends and family members would describe themselves as hard workers.

and right below it:

93% of millionaires say they got there by hard work rather than big salaries

Seriously, who is going to say anything else? “I’m actually a slacker, and just lucked into being a millionaire. Also, I just got a huge salary and didn’t really need to work very hard.“

I’m not saying that no one is like that, but I am saying that anyone who would self-identify as a lucky slacker is not going to take part in a survey like this.

I know that whole point is to advertise that you need to be hard worker to become a millionaire. I just didn’t need 10,000 self-identifying Dave Ramsey fans telling me this.

Here are a collection of other statistics that felt useless, irritating, or other-wise content-free:

97% of millionaires believe they control their own destinies

82% of millionaires describe themselves as optimists

98% of millionaires say they actively integrate feedback from other people

76% of all millionaires say that anyone in America can become a millionaire with discipline and hard work

Give me a break.

Sure, not every statistic is as toothless as the above, but so many of them stuck out as being just so unscientific as to be not worth devoting any time to them.

Summary

So even though I don’t put much stock in many of the statistics, and even though I’m disappointed by the lack of transparency and rigor in the book’s methodology, I still agree with the book’s fundamental premise: Anyone can become a millionaire.

So given that the premise of the book is to try and convince you of something (with the author’s obvious conflict of interest), and given that the methodology is flawed or at least heavily biased, and given that the responses are often platitudes designed as statistics, is this a book that is worth your time?

Yes, the book is absolutely worth reading.

The book is enjoyable, energetic, and fast-paced. The book is best when it seeks to motivate you, and to break down your objections. Yes, it tries to bludgeon you with percentages that feel suspect, but the underlying ideas feel sound.

For example, I do believe that you need to work hard to achieve financial success. I do believe that using credit cards will hinder your progress. I do believe that you need to spend less than you earn. I do believe that using your workplace retirement plan (if you have access one) is a bigger driver of wealth than almost anything else you could do.

The primary persuasion for me isn’t statistics, or seeing yourself just like other millionaires, it’s the belief itself. If you are able to envision yourself as a millionaire, if you believe that it is possible for you, you are more likely to take consistent steps that will get you to that point. And Chris Hogan is an excellent motivator.

So even though I don’t put much stock in many of the statistics, and even though I’m disappointed by the lack of transparency and rigor in the book’s methodology, I still agree with the book’s fundamental premise: Anyone can become a millionaire.

Perhaps this is the book that helps you believe that you can too.

But enough about me. Do you think that you can become a millionaire?

Everyone struggles with money, but most will try to muddle through on their own. Will you be different? I help people from all over the world reach their financial goals. Let’s talk.